Aenert news. Energy resources and infrastructure

Today, graphite has become the most discussed item among the so-called "critical" materials for future development purposes. This is not unexpected, as a number of experts have long been signaling the growing imbalance between production and demand for graphite.

Nevertheless, after China imposed restrictions on exports of a number of the important graphite grades in October of this year, the situation is leaving the realm of calm analysis and requires more active and concrete measures for prevention of possible disruption of production in some sectors of the economy. Let us try to understand the essence of the problem and options for its solution.

Why graphite is on the list of critical materials?

Graphite, at the level of atomic structure, is a carbon-based crystalline material consisting of numerous layers of graphene stacked on top of each other. The number of unique properties of graphite are widely known: low density, resistance to chemical influences, satisfactory strength and electrical conductivity, good thermal conductivity, very high melting point approaching 4000oC. We will not further expand the list of known facts about the properties of graphite – they can easily be found in any reference book – and only dwell on one, rarely mentioned property, which is directly related to the topic of this commentary. It is called intercalation capacity. In the most simple terms, it is the ability of one substance to place in its crystal lattice atoms of another substance without critical consequences. So graphite has excellent characteristics of intercalation and deintercalation with some elements and first of all with lithium. By the way, it is exactly these processes which take place on graphite anodes of lithium-ion batteries.

Graphite is widely found in nature, which is why it is called natural graphite. On the other hand, a large amount of synthetic graphite is produced. In the industry, graphite is widely used, e.g. as electrodes for electric arc melting, as an indispensable refractory material, solid lubricants, a working element in braking systems, a battery element, a reactor material, etc. and of course in the form of ordinary graphite pencils.

Graphite Manufactured Articles. Envato. UQCW9RVZLP

Despite the fact that graphite demand has been increasing every year, to date this trend has not been overwhelmingly strong. On the contrary, the emerging local imbalance in the market has always been equalized due to the flexibility of production and sufficiency of the resource base. However, it is now predicted that a huge deficit of graphite may arise already in the coming years. The reason for this is the increasing growth of electric vehicles. The fact is that each of them uses approximately 70 kg of graphite. Below is a table of the main types of lithium-ion batteries that are predominantly used in electric vehicles and other energy storage systems. As can be seen, all of them use only graphite as an anode material.

Characteristics of the main types of lithium-ion batteries

| Types of Lithium-ion battery | Voltages, V | Energy density, Wh/kg | Cycle life | Main advantages / disadvantages | Applications |

|---|---|---|---|---|---|

| Lithium Nickel Manganese Cobalt Oxide (NMC), сathode- LiNiMnCoO2, аnode - graphite | 3.6 | 150 - 220 | 1000 - 2000 | high specific energy or specific power, long-life cycle, good safety and thermal stability / mechanical instability of the cell | electric cars, electric motorcycles, power tools, portable |

| Lithium Iron Phosphate (LFP), cathode - LiFePO4 аnode - graphite | 3.2 | 90 - 120 | 2000 and more | long-life cycle, good safety and thermal stability, cost-effective, high specific energy / relatively high self-discharge rate; low cell voltage, low energy density | electric cars, electric bikes, medical equipment, backup power, utility scale stationary applications |

| Lithium Cobalt Oxide (LCO), cathode - LiCoO2 Anode - graphite | 3.6 | 150 - 200 | 500 - 1000 | High energy density / short life-span; low specific power, limited high load capability | laptops, mobile phones, cameras |

| Lithium Nickel Cobalt Aluminum Oxide (NCA) cathode - LiNiCoAlO2, аnode - graphite | 3.6 | 200 - 260 | 500 | High energy density and power density, long life span, fast-charging capability / safety problems, relatively high cost | electric cars, electric appliances |

| Lithium Titanate (LTO), catode -Li2TiO3 аnode - graphite | 2.4 | 50 - 80 | Up to 7000 | Fast charge, high cycle life, good safety and thermal stability / low energy density, relatively high cost | electric buses, aerospace, renewable energy storage |

But let's return once again to intercalation. Thanks to this very ability graphite became indispensable in lithium-ion batteries. In the process of charging such a battery at the cathode, lithium atoms easily part with their only electron on the outer shell. The flow of the electrons to the anode through the external circuit generates an electric current, and the resulting lithium ions drift to the anode through the electrolyte.

There, the graphite readily accepts them by placing the lithium ions between the layers of its crystal lattice. This produces lithium carbides, but these are readily broken down into their original components in the discharge mode, which is accompanied by deintercalation. In this bundle, the battery can experience several thousand charge-discharge cycles. For now, there is no material which can replace graphite. An attempt to use silicon compounds as anodes leads to rapid destruction of the same, which can also happen with graphite, but much less often. This is due to the fact that graphite has another important ability - to slightly expand the size of its crystal lattice when lithium ions are intercalated, and return to the initial state when in the deintercalation mode. Simply put, lithium ions, with their relatively small size, and graphite, with its ready intercalation ability, have successfully found each other.

Now let us look at forecasts of electric vehicle production. As usual, data divergence is very high, but relatively restrained forecasts converge to about 20 million electric vehicles by 2030[1], i.e. about three times the volume of their production in 2022. However, according to EV-Volumes[2], 6 million Battery Electric Vehicles and Plug-in Hybrids (PHEVs) were sold globally in the first half of 2023 alone (BEVs – 4.27 million). At such growth rates, the total number of electric vehicles by 2030 could be close to 30 million, and the share of BEVs could increase significantly from the current 70-75%. It should be noted that there are also much more optimistic forecasts. Accordingly, by 2030, graphite production for the industry's needs alone should increase in similar proportions relative to current levels. In its Stated Policies Scenario (STEPS), International Energy Agency[1] calculated the global graphite demand for EV batteries at 1065kt by 2030. For the more dynamic Sustainable Development Scenario (SDS) this amount rises to 2499kt. The World Bank[3] based on the 2DS only to 2050 model calculated that this would require more than 4.5 million tons of graphite (an increase of more than 450%). Wood Mackenzie estimates that the graphite index will grow six times by 2030 relative to 2020 and more than 10 times by 2040[4]. Roskill acquired in 2021 by Wood Mackenzie previously forecast graphite consumption growth from battery manufacturers at a CAGR of 27%[5]. Global graphite demand under this model could already reach around 700,000 tons by 2025. SGL Carbon, one of the leading synthetic graphite producers, expects global graphite demand to reach 2-3 million tons by 2030 [6]. Serious analytical groups such as Rystad Energy[7] and Benchmark Source[8] predict no less dynamic growth of graphite demand and present fairly pessimistic prospects in their forecasts. Looking at their data, the imbalance in the graphite market has already begun, and from now on it will only grow, which will obviously be accompanied by growth and significant price fluctuations, intensification of competition and other signs of instability.

Annual Mineral Demand Under 2-degree scenario. Only from Energy Technologies in 2050, Compared to 2018 Production Levels

Source: Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition. 2020. The World Bank

To be fair, it should be noted that some market analysts are much more restrained in their assessment of the graphite market growth, with a CAGR of about 4 to 7%.

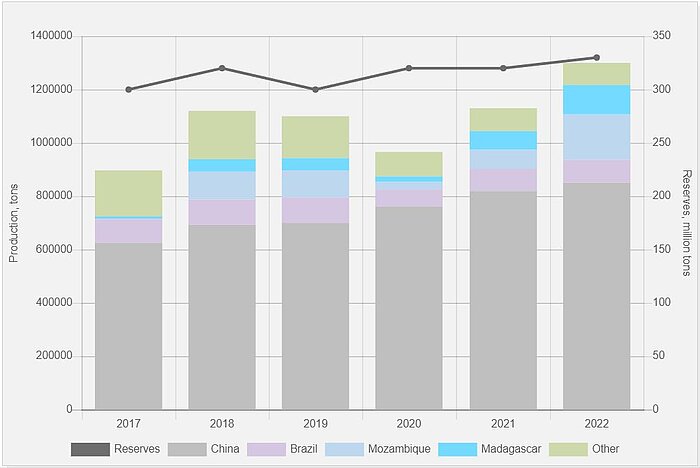

Summarizing the above and taking into account the diversity of estimates, let us dwell on a generalizing conclusion, as it is done in Innovation News Network[9]: "Today, approximately 200,000 metric tons of graphite anode powder is used for lithium-ion batteries; however, predictions for future demand of graphite anode powder range from 3 to 20 times the current amount". In addition, we note that the production of natural graphite 20 years ago exceeded one million tons per year, and only in 2022 it reached 1.3 million tons. That is, the historical growth rate of natural graphite production is very modest. Synthetic graphite production can develop more dynamically, but there are many reservations there as well, which we will consider further. Therefore, under any of the above-mentioned forecast scenarios, graphite is a typical "critical" material, as its production prospects may not coincide with the growing demand.

Natural and synthetic graphite

Both natural and synthetic graphite is used for anode batteries. This is certainly a great advantage for diversification of production, although in fact more than 70% of both types of graphite are delivered from China.

Basic information on natural graphite is given in the map below. According to[10], the world's graphite reserves total 330 million tons, of which the first seven countries account for more than 90% of the reserves.

Global natural graphite reserves and production

![]() Map of world reserves of natural graphite by country

Map of world reserves of natural graphite by country

China has dominated the production of natural graphite for many years. In spite of the fact that serious volumes are also supplied to the markets from Madagascar and Mozambique, it should be taken into account that a part of these resources goes to China for processing. Of the existing forms of natural graphite (amorphous, flake, and vein), only flake graphite is suitable for anode materials. This is due to the fact that satisfactory intercalation of lithium ions to anodes requires a high degree of packing of graphite raw material, which is achieved by using micronized and spherodized graphite, and flake graphite is the best suited for this purpose. This noticeably limits the initial resource base of graphite. In addition, the operations of deep grinding of graphite raw materials are very energy-consuming and lead to significant losses of raw materials at the output of the process. The higher the carbon content of graphite, the higher its cost. Spherodization further increases its cost.

World production of natural graphite

Source: U.S. Geological Survey

The main material for production of synthetic graphite is Petroleum Coke, which is a solid amorphous carbon residue formed after high-temperature decomposition of solid or liquid hydrocarbons. If the feedstock contains a lot of sulfur, various operations are used to remove it, including hydrogen. The coke is then graphitized, i.e. subjected to high-temperature heat treatment to form a crystalline structure from the original amorphous carbon. Blanks of finished products are molded after mixing graphite with filler particles, which are further subjected to slow high-temperature treatment. All these technological operations are extremely energy-intensive, which leads to a significant increase in the cost of the final product. The main application of synthetic graphite is the production of electrodes, however, the production of battery anodes is steadily increasing. Due to the absence of world trading hubs for synthetic graphite and the diversity of the raw materials, systematic accounting of this product is difficult. There is data that at present the production volumes of synthetic graphite are approximately twice as high as the production volumes of natural graphite[4]. As for the shares of natural and synthetic graphite used in the production of anodes, the data traditionally vary greatly from source to source. For example, in Natural Resources Canada[11] this ratio is 34% (natural graphite) to 66% (synthetic graphite), in[9] it is approximately the same (35 to 65%), but in[7] it is noted that the share of synthetic graphite will increase from the current 78% to 87%. In actual anode designs, natural and synthetic graphite are mixed in a certain proportion, e.g. 50/50%.

Problems of expanding graphite production

So, let us summarize the intermediate outcomes and recount some facts:

- To ensure the processes of reducing carbon dioxide emissions and promoting the "green agenda", accelerated production of electric vehicles, as well as energy storage systems in the form of rechargeable batteries is expected;

- Lithium-ion batteries are the most promising battery type for vehicles and energy storage systems;

- Currently, the only material used to produce lithium-ion battery anodes is graphite;

- Most analysts predict that the current rate of graphite production will not be able to meet the increasing rate of demand for graphite from lithium-ion battery manufacturers;

- Multiple increases in graphite production, both natural and synthetic, will be required over the next several years;

- Currently, production of both natural and synthetic graphite is predominantly concentrated in China;

- China has recently introduced licensing for the export of graphite suitable for the production of battery anodes;

- There are other consumers of graphite that may see an increase in current demand, most notably the steel industry.

Now let's consider what can really help to overcome the current situation.

Development of natural graphite production

Expansion of natural graphite production is quite a smart option, especially since there are enough world resources, and production of spherical graphite itself is not a technically difficult task. The only problem is that choosing this option requires organizing of graphite mining and subsequent processing, and this is cannot be achieved quickly. Moreover, it is a multi-year cycle, requiring additional licensing and serious investments. Besides, according to[8], today China controls 67% of mined graphite. However, at the spherical graphite stage, China's share reaches 99%. The share of the rest of the world in the total natural graphite supply chain remains only at 25%.

Thus, a rapid increase in the production of natural graphite cannot be relied upon, although in any case it is possible in the medium term. At the same time, it is virtually impossible to supply the market with this product without China. But is China going to increase its natural graphite production on a large scale? Judging by the statement in[12], it is unlikely that this will be done with the required intensity. In general, the situation appears to be hopeless.

Development of synthetic graphite production

Also a good and obvious idea. There should be no problems with raw materials, the technology, although not easy, does not raise insurmountable barriers, especially for developed countries with a high level of mechanical engineering and oil refining. Dependence on China can be overcome. It is obvious that everything can be organized within two or three years. But again there are serious challenges. And they are not technical, organizational or financial, but rather existential.

From the ecological point of view, the production of synthetic graphite is by no means an ideal one. According to[8], when producing one ton of synthetic graphite, carbon intensity is more than 3.5 times higher than when producing natural graphite. Thus, a vicious circle is formed - in order to reduce CO2 emissions, the production of electric vehicles increases, but at the same time the production of synthetic graphite also increases with a simultaneous increase in CO2 emissions. The production of synthetic graphite requires petroleum coke, i.e. a product of refining an ineradicable fossil fuel. In addition, high energy costs will be required, which renewable energy sources will obviously not be able to provide; natural gas, fuel oil or, completely nonsensical, coal will be needed.

Europe is particularly vulnerable concerning this option, where the most stringent environmental standards have been introduced and the resource base is limited. It is much easier to develop this industry in the USA. Meanwhile, there are no special problems for China. Petroleum Coke will suffice there and CO2 emissions are not so painful. According to a number of reports, already in 2022 the graphitization capacity of synthetic graphite in China has significantly increased and exceeded 2 or even 3 million tons. However, it is not clear what the share of synthetic graphite for battery anodes is. As a result, there is once again a feeling of hopelessness in the face of China's dominance in this market and synthetic graphite production, but on the other hand, the tension in the global balance of supply and demand is reduced at the expense of China. The vicious circle repeats itself again.

Reuse of graphite

Basically, this is indeed possible on a significant scale. However, it is more economically feasible for other graphite applications, especially in metallurgy. Extraction and additional processing of secondary graphite from lithium-ion batteries requires considerable organizational efforts and serious investments. In any case, it is not likely to be established quickly enough to have a noticeable impact on the market.

Graphite production projects

In spite of everything, let us keep an optimistic outlook on the future. Below we give a description of several projects that may significantly affect the graphite market.

1. Anovion Technologies

In May this year, US-based Anovion Technologies announced a large-scale expansion of the company's production capacity to produce high-quality synthetic graphite anode materials. The company reported that the new facility in southwest Georgia will produce 40,000 metric tons per year of synthetic graphite anode material for lithium-ion batteries. The initial investment will be $800 million. The company's multi-year program envisages a capacity expansion to 150,000 metric tons per year.

2. The Ruby Graphite Project

It is a previously abandoned ruby graphite deposit located in southwestern Montana, USA. It contains flake and vein graphite with carbon content from 95.8% to 98.4%. Reflex Advanced Materials, an exploration company, is developing the project. The company is awaiting a grant from the Department of Energy to develop the project at one of the few graphite deposits in the US. The Graphite Resource (Grade & Tonnage) estimate will be completed in 2024 Q3.

3. Synthetic graphite pilot project Mineral Resources + Hazer Group's

Mineral Resources, an Australian iron ore company, intends to build a plant in Perth to produce 1,000 tons per year of high frequency synthetic graphite with future expansion to 10,000 tons depending on demand. The project will utilize Hazer's low-CO2 technology (The HAZER® Process), which uses natural gas and unprocessed iron ore to produce synthetic graphite and hydrogen, which can also be used as a clean fuel. The company has now completed construction of a Commercial Demonstration Plant (CDP) located in Perth, Western Australia.

4. Vianode project

The Norwegian company Vianode has developed a range of synthetic graphite products with unique performance characteristics. In April 2021, the company launched a pilot plant in Kristiansand, Norway. By 2024, commercial production is planned at a facility in Industry park Heroya, Norway. By 2030, Vianode will produce battery materials for 2 million electric vehicles per year.

5. Vittangi natural graphite project

The graphite ore deposit located in Norrbotten County, Sweden hosts the Nunasvaara deposit, which has exceptionally high carbon content. Due to the unique circumstances of its formation, it is particularly well suited for use in lithium-ion batteries. Talga's use of Swedish hydropower and industry-leading efficient refinery processes, Talga's anodes are the greenest in the world. Talnode™-C is made from our unique Swedish high-grade natural graphite and proprietary coating processes to offer industry-leading active anode in sub-6 micron sizes. Talga Group Ltd is a fully integrated producer of lithium-ion battery anode products, technologies and industrial graphene additives. The Company is building a natural graphite anode facility in Sweden running on 100% renewable electricity, to produce ultra-low emission coated active anode for greener lithium-ion batteries. The Vittangi graphite project, which is planned to be developed in phases, will include an open pit mine and an on-site processing plant. Graphite concentrates from the project will be fed to Talga's planned anode processing plant near the port of Lulea to produce high-performance graphite anodes for lithium-ion batteries. Capital costs for the second phase of project development are estimated at $174 million. The Vittanga graphite project is expected to produce up to 19,000 tons of graphite anode material for lithium-ion batteries per year over the anticipated life of mine starting in 2024.

6. Yunnan Shanshan graphite project

The US$1.3 billion synthetic graphite anode production project is being implemented in two phases. The first phase with a design capacity of 200,000 tons per year has already started production. It is also planned to build the second phase with a capacity of 100,000 tons. The project is being implemented by Yunnan Shanshan, a subsidiary of major graphite anode producer Shanshan Technology in Yunnan province.

7. Mahenge Liandu natural graphite project

Mahenge Liandu is an open pit high quality graphite mining project located in Tanzania, East Africa. The Mahenge Liandu project, which is planned to be implemented in two phases, is expected to produce 60,000 tons of graphite concentrate per year during the first four years of operation in the first phase. Production capacity will be increased to 90,000 tons per year during the remaining 13 years of mine operation in the second phase. The Mahenge Liandu graphite deposit is estimated to contain 59.5 million tons of graphite.

8. NOVONIX project

US-based NOVONIX is expanding domestic production of high-performance synthetic graphite anode materials at its Riverside facility in Chattanooga, Tennessee, USA. According to the project, a 30,000 tons per year synthetic graphite plant is scheduled for construction, with a subsequent expansion to 150,000 tons.

9. Syrah Resources project

Australia's Syrah Resources is building an 11,250 tons per year graphite anode plant in Vidalia, Louisiana, USA to process graphite mined in Mozambique. In addition, the plant is scheduled for future upgrades to expand production to 45,000 tons. Syrah Resources is positioned as an alternative supplier of graphite anode material to the US and Europe, which are currently positioned to be dependent on supplies from China. Syrah Resources has a firm deal with Tesla Inc to supply 8,000 tons of graphite anode material from the first phase of the Vidalia plant and an option for an additional 17,000 tons following a planned plant upgrade.

10. Skaland Graphite - expansion of production (Norway, natural graphite)

Skaland is the only graphite mine in Scandinavia, the biggest crystalline graphite producer in Europe. Skaland is presently the world’s highest-grade operating flake graphite mine with mill feed grade averaging ∼25 percentage. The Skaland graphite operation is located in northern Norway on the island of Senja and is approximately 213 km from TromsØ. Resource (2021) at the Skaland Graphite Operation for the underground Traelen Graphite Mine is estimated at 1.84 million tonnes. Pursuant to recently received regulatory approvals, the Skaland Operation’s production limit can be increased to produce up to 16,000 t /y.

11. Lac Guéret Graphite Project (Canada, natural graphite)

Here's what the Mason Resources website says about this project: “Joint Venture option with Nouveau Monde. Mason Resources 100% owned Lac Guéret project is located in northeastern Quebec, about 285 km north of the main service centre of Baie-Comeau and about 660 km from Montreal, Canada. Mason Resources and Nouveau Monde Graphite Inc (NMG) entered into an option and joint venture agreement to collaborate to advance the project. Conditions for the formation of the Joint Venture include: (i) a minimum of C$10.0 million of expenditures from Nouveau Monde Graphite Inc on the project, and (ii) the completion of an updated feasibility study on the project based on an estimated production scale of a minimum of 250,000 tonnes per annum of graphite concentrate, to be ascertained based on customer demand as well as technical and environmental possibilities. Assuming the exercise of the option and formation of the joint Venture, NMG’s and Mason Resources’ interest in the joint venture to be 51% and 49%, respectively, and NMG to be appointed as operator of the Joint Venture”.

As follows from the list of current projects, which is far from complete, the active movement to increase graphite production in the world is gaining momentum. Moreover, we are talking about projects related to both natural and synthetic graphite. Therefore, there is probably no point in panicking about the global imbalance of graphite on the market. Moreover, each of the newly successfully implemented projects, in the presence of real demand, will help increase investment interest and further optimize the market. However, questions remain regarding the diversification of supplies and the environmental maturity of synthetic graphite production. And full-fledged solutions to them are not yet visible.

References

[1] Mineral requirements for clean energy transitions/ www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/mineral-requirements-for-clean-energy-transitions

[2] Global EV Sales for 2023 H1/ www.ev-volumes.com/country/total-world-plug-in-vehicle-volumes/

[3] Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition/ The World Bank/ 2020 / www.commdev.org/wp-content/uploads/pdf/publications/MineralsforClimateActionTheMineralIntensityoftheCleanEnergyTransition.pdf

[4] ECGA (European Carbon and Graphite Association)/ ecga.net

[5] Supply and Demand of Natural Graphite/ DERA Rohstoffinformationen/ 2020/ www.deutsche-rohstoffagentur.de/DERA/DE/Downloads/Studie%20Graphite%20eng%202020.pdf

[6] SGL Carbon/ www.sglcarbon.com

[7] Fake it till you make it: Synthetic graphite holds the key to meeting battery demand surge, despite ESG concerns/ 10.11.2022/ www.rystadenergy.com/news/fake-it-till-you-make-it-synthetic-graphite-holds-the-key-to-meeting-battery-dema

[8] What to expect for graphite in 2023?/ 11.01.2023/ source.benchmarkminerals.com/article/what-to-expect-for-graphite-in-2023

[9]125 years of synthetic graphite in batteries/ 7th March 2022/ www.innovationnewsnetwork.com/125-years-synthetic-graphite-batteries/16303/

[10]Graphite Statistics and Information/ USGS/ pubs.usgs.gov/periodicals/mcs2023/mcs2023-graphite.pdf

[11]Graphite facts/ natural-resources.canada.ca/our-natural-resources/minerals-mining/minerals-metals-facts/graphite-facts/24027

[12]China strengthens export controls on graphite, a vital material for EV batteries, to protect national security/ www.globaltimes.cn/page/202310/1300240.shtml

By the Editorial Board