Aenert news. Energy Companies

Data on the production of bituminous oil and the production of synthetic products from it are an important indicator of the state of the global oil market as a whole. Canada is the absolute leader in the extraction and processing of oil sands, successfully competing with other producers. It should be taken into account that the costs of developing heavy and bituminous oil deposits are significantly higher than those for conventional oil. In this regard, the profitability, or at least break-even, of Canadian producers is a relative threshold beyond which, in most cases, the rest of the oil market is relatively stable. Of course, this cannot apply to local events or stressful situations.

Data on the production of Conventional light crude oil and Heavy Crude Oil, as well as the production of Upgraded Bitumen in the second quarter of this year (2023Q2, Apr, May), published by Canada Energy Regulator, indicate a significant decrease in production output for all of these items. It is possible that the data for June, which has not yet been presented, will partially change the final results, but not radically. The decrease in Heavy Crude Oil production volumes was especially noticeable - by 3.25% compared to the same quarter last year and by more than 6% compared to the previous quarter.

Production of Canadian crude oil and equivalent (average, b/d, 19.09.2023)

| Time/Oil | Conventional light crude oil | Upgraded Bitumen | Heavy Crude Oil |

|---|---|---|---|

| 2023Q2 (Apr, May) | 656 227 | 1 099 463 | 2 375 183 |

| 2023Q1 | 681 427 | 1 245 112 | 2 536 606 |

| 2022 | 663 348 | 1 168 149 | 2 562 420 |

| 2022Q2 | 678 712 | 1 102 139 | 2 454 940 |

| 2021 | 654 081 | 1 180 746 | 2 455 984 |

Source: Canada Energy Regulator

It should be noted that a year earlier, market prices for oil products were significantly higher than in the current quarter. For example, bitumen fell from more than 112 to 68.6, and Synthetic crude oil from 145 to 101 (Canadian dollars per barrel). Of course, this could not but affect production indicators. In addition, the forest fires that raged in Canada inevitably had a negative impact on production activities.

Below is a brief analysis of the performance of leading Canadian oil producers in the second quarter of 2023.

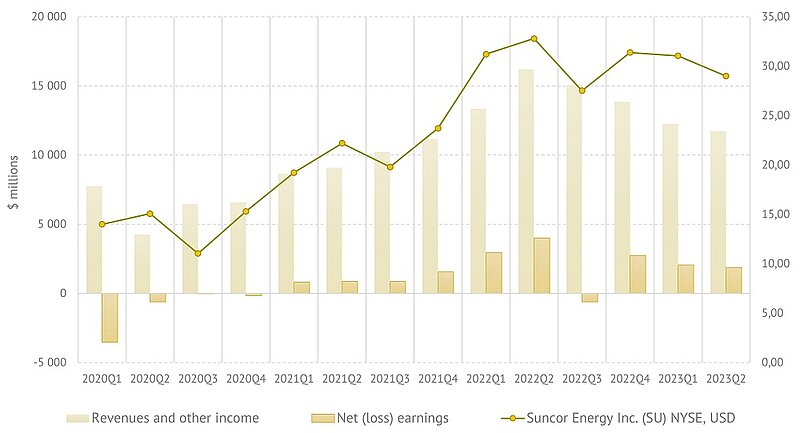

Suncor Energy Inc.

Suncor is an integrated energy company headquartered in Calgary, Alberta. The company primarily engages in the development, production and modernization of oil sands as well as offshore oil and gas production and refining operations in Canada and the United States. In the second quarter of this year, Suncor Completed all major annual planned maintenance across all refineries, resulting in refinery crude throughput of 394,400 barrels per day (bbls/d).

Total upstream production (mboe/d) amounted to 741.9 versus 742.1 in 2023Q1 and 720.2 in 2022Q2. Net revenue in the second quarter was $1,879 million. This is significantly less than a year earlier - $3,996 million. Adjusted operating earnings were at $1,253 million. Suncor's total operating, selling and general (OS&G) expenses for the second quarter of 2023 were $3.440 billion, compared to $3.088 billion in the prior year quarter. In its quarterly report, the company said the increase in expenses was primarily due to $275 million in restructuring costs (workforce reductions, increased mining activities, increased maintenance costs).

Suncor Energy. Revenue, net income and share price

Source: Suncor Energy Inc.

The company's share price has been subject to only slight adjustments over the past year and a half.

Cenovus Energy Inc.

Cenovus Energy primarily produces oil through steam-assisted gravity drainage in the Fort McMurray area. The company's headquarters are located in Calgary, Alberta. As of the end of 2022, the company has three oil projects - Foster Creek, Christina Lake and Sunrise, of which the most productive are Foster Creek and Christina Lake. Cenovus Energy also acquired a 50% stake in the Sunrise oilfield asset last year and acquired oil producer Husky Energy for C$3.9 billion a year ago.

Cenovus’s total revenues were approximately $12.2 billion in the second quarter. Upstream revenues were about $6.8 billion, similar to the previous quarter, and downstream revenues were $7.6 billion, compared with nearly $7.4 billion in the first quarter. The company's second-quarter net income was $866 million, compared $636 million in the prior-year quarter. According to the press release, the increase in net income was primarily due to higher operating margins and favorable unrealized foreign exchange gains, partially offset by higher income taxes.

Total upstream production was 729,900 BOE/d (779,000 BOE/d in the previous quarter and 761,500 BOE/d in the same quarter a year earlier). Total downstream throughput reached 537,800 bbls/d in 2023Q2. During the second quarter, throughput was increased at the Toledo Refinery and the Superior Refinery was prepared to start up its fluid catalytic cracking unit.

The company's share price continued to decline slightly after peaking at the end of last year.

Cenovus Energy. Revenue, net income and share price

Source: Cenovus Energy Inc.

Imperial Oil Limited

Imperial Oil is involved in such projects as Kearl, Cold Lake and Syncrude in Alberta. Oil production is carried out by both mining method and In-Situ through Cyclic Steam Stimulation. Imperial Oil is another of the leaders in bituminous oil production and refining. ExxonMobil, the largest U.S. oil company, owns about 70% of the Imperial Oil. In addition to bituminous oil production and refining activities, Imperial Oil is active in natural gas production and petrochemicals production. At the end of the first half of this year, Kearl produced 169,000 b/d (146,000 b/d a year earlier), Cold Lake produced 137,000 b/d (142,000 b/d) and Syncrude produced 71,000 b/d (79,000 b/d in H1 2022). Refinery throughput in Q2 2023 reached 388,000 b/d (412,000 b/d a year earlier).

Total revenue from operations in the second quarter was 11,764 versus 17,285 in the same quarter last year (millions of Canadian dollars). Net income in 2023Q2 decreased significantly to 675 compared to the same period last year, when it was 2,409 (millions of Canadian dollars).

The company's share price has stabilized in the range of $51-53.

Imperial Oil. Revenue, net income and share price

Source: Imperial Oil Limited

Despite the decline in oil production and refining in Canada in the second quarter of 2023, as well as a significant decline in the overall revenue and profits of leading oil companies, the overall results presented cannot be considered unsuccessful. Moreover, as mentioned above, these results were significantly influenced by extreme forest fires in Canada and a decrease in oil market prices. Production figures should be expected to improve in the second half of 2023 following improving market conditions.

By the Editorial Board