Aenert news. Energy Companies

Oil and gas production from low-permeability plays, like the bituminous oil production that we discussed in our last release, requires solving of complex engineering challenges and additional investments compared to conventional oil and gas production. For the United States, where large-scale commercial production of shale gas and tight oil began about two decades ago, addressing these issues is most relevant because today it is these products which define the image of the country's energy industry and are a showcase of advanced technologies for unconventional resource exploration and directional well drilling. It is especially interesting to look at the production and financial performance of operators in this market amid relatively low global crude prices in the first quarter of this year (2023Q1).

The chart below shows strong growth in both shale gas and tight oil production in the US for at least the last four quarters. This was against the backdrop of OPEC+ countries' insistence on production cuts.

US average daily production of shale gas and tight oil

Source: EIA.gov

Based on the data provided, the average daily production of tight oil in the current quarter has reached the pre-crisis levels of 2020Q1 (8.4 million barrels of oil per day), and shale gas production has significantly surpassed them, reaching the level of 85 billion cubic feet per day. For oil, the largest contributors to production were Wolfcamp (TX & NM Permian), Spraberry (TX Permian), Bakken (ND & MT), and for gas: Marcellus (PA, WV, OH & NY), Permian (TX & NM), Haynesville (LA & TX). More precise data and deciphering of the given designations can be easily found on the U.S. Energy Information Administration (EIA) website under Petroleum & Other Liquids and Natural Gas.

Despite this optimistic data, there are some alarming signals. For the past four or five months, wells numbers and footage drilled have stopped growing. For example, Horizontal and Directional footage drilled in 2023Q1 has stabilized at just under 21,000,000 feet without any sign of the growth which was seen in 2022. In addition, the number of drilled but uncompleted wells has been declining markedly in recent years. According to the authors of "Number of drilled but uncompleted U.S. wells continues to decline from record in 2020", the decline in the number of drilled but uncompleted wells could limit future growth in crude oil and gas production.

Below we have a a look at the production and financial performance of some leading U.S. companies in 2023Q1 that have significant shares of U.S. shale gas and tight oil production.

EOG Resources

EOG Resources, Inc. is one of the largest crude oil and natural gas exploration and production companies in the United States, most of which is shale gas and tight oil. The company is characterized by constant innovation and a relentless drive to cut capital and operating costs. In 2022, a record year for the company, it earned $8.1 billion in profits, $5 billion of which went to shareholders in the form of dividends. EOG Resources operates primarily in the U.S. in in areas of operations such as Eagle Ford, Permian Basin, South Texas and many others, as well as in Trinidad. Last year, major successes in EOG Resources' business could be achieved with the help of its exploration teams, who advanced several new fields. Another important achievement of the company should be noted, namely the increase in the wellhead gas recovery rate to 99.9%.

EOG Resources. Revenue, net income and share price

Source: based on EOG Resources

In 2023Q1 the company continued to show successful performance. Oil production was 457.7 MBbld and gas production was 1,639 MMcfd. This represents an increase of 1.7% and 12.4% compared to the same quarter of the previous year, respectively. Total Operating Revenues were $6,044 mln compared to $3,983 mln a year ago. Crude Oil and Condensate accounted for over 50% of the turnover. Net Income in 2023Q1 is recorded at slightly over $2 bln, compared to $390 mln in 2022Q1. The value of the company's shares more than quintupled after the crisis in 2020.

Devon Energy

Devon Energy Corporation is one of the largest independent energy companies in the United States. The company has a first-class portfolio of oil and natural gas assets. At the end of 2022, reserves totaled 1,815 MMBOE of which oil accounted for 44%. Devon operates in five major regions - Delaware Basin, Eagle Ford, Anadarko Basin, Powder River Basin and Williston Basin. The Delaware Basin is the most productive of these regions. Devon is headquartered in Oklahoma City.

Devon Energy. Revenue, net income and share price

Source: Based on Devon Energy Corporation

In 2023Q1 Devon produced 320 MBbld of oil and 1,030 MMcfd of gas, an increase of 11% and 13.6% from the same quarter the previous year, respectively. Total Revenues were $3,823 mln, which is about the same as a year earlier, but significantly less than in the second to fourth quarters of 2022. Obviously, this is primarily due to the drop in global energy prices. Net Income in 2023Q1 was at $ 995 mln. The company's share price reached its peak in the fourth quarter of last year, but then dropped noticeably.

Occidental Petroleum Corporation

Occidental Petroleum Corporation (Oxy) is an American oil and gas production company headquartered in Houston, Texas. The company operates in the USA (Permian, Gulf of Mexico, Rockies), the Middle East (Oman, Qatar, United Arab Emirates) and Colombia. At the end of the last year proved reserves were - 1913 MMbbl Oil, 846 MMbbl NGL and 6350 Bcf natural gas. Most of the reserves are concentrated in the United States. The company's assets increased significantly after it acquired Anadarko Petroleum in 2019. The company's total reserves are estimated at 3,817 MMboe.

Oxy's signature method in Permian is using one of the Enhanced Oil Recovery options of injecting CO2 into the underground reservoir, which also addresses environmental concerns. Oxy currently stores up to 20 million tons of CO2 per year and has more than 2,500 miles of CO2 pipeline. Oxy produces a wide variety of oil grades, including Saddlehorn Light, Heavy Louisiana Sweet, West Texas Intermediate and others.

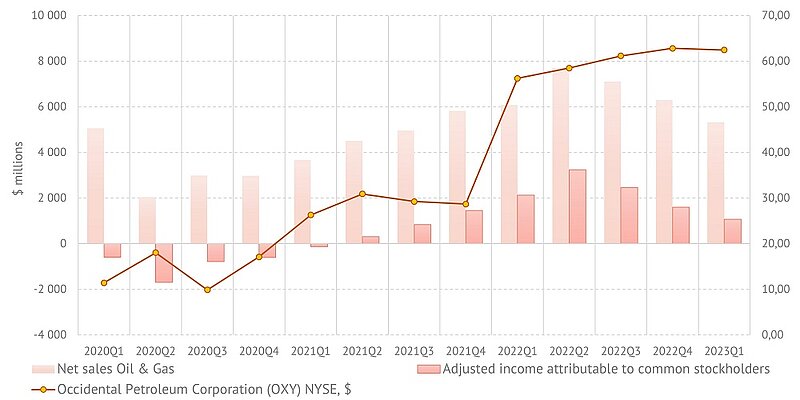

In the first quarter of 2023, the company had total sales of $7,258 mln of which oil and gas accounted for $5,325 mln. Production during this period was 1,014 (57% Permian) in the United States and 206 MBOE per day overseas. U.S. oil and gas production in 2023Q1 exceeded that for each of the 2022 quarters. On the other hand, Net Income for the oil & gas sector was at $1,203 mln, significantly less than a year earlier or in the previous quarter. That said, keep in mind that in 2023Q1, the average quarterly price of WTI oil was about 20% lower than in 2022.

Occidental Petroleum Corporation. Revenue, net income and share price

Source: Based on Occidental Petroleum Corporation

It is difficult, however, to isolate indicators directly related to shale gas and tight oil production from the available information for Occidental Petroleum Corporation. Nevertheless, it is obvious that the company's share of these products is high, taking into account Oxy's active operations in Permian, which is one of the main regions of their production in the United States. The company's share price on the NYSE has stabilized at just over $60 apiece.

The above data on shale gas and tight oil production in the U.S. shows a strong recovery of this energy sector in the last two years after the "covid" year of 2020. This is also partly evidenced by the brief statistical breakdowns of individual company activity given above, although of course many more should be considered to make the results more reliable. In addition, the concerns raised about drilling performance should not be forgotten to assess the prospects for this sector.

By the Editorial Board