Aenert news. Energy Companies

The development and subsequent industrial development of shale gas and tight oil production technologies, which was carried out at the beginning of this century in the USA, made significant changes to the oil and gas balance at the global level. Today, of the approximately 13 million Barrels per Day of oil produced in the United States, more than 60% is tight oil. If we consider the production of natural gas, then the share of shale gas is generally about 80%. Thus, on the one hand, the USA is currently the leading producer of hydrocarbons in the world, and on the other hand, the main contribution to this result comes from shale gas and tight oil production. The list of mandatory technological operations for the production of these difficult-to-recover types of oil and gas inevitably includes horizontal drilling and hydraulic fracturing; in addition, a significantly larger number of wells is required compared to the production of traditional types of hydrocarbons. Of course, this increases operating costs and increases the sensitivity of production processes to various unfavorable factors. However, the state of shale gas and tight oil production serves as a good indicator of the entire energy sector, not only in the USA, but also at the global level.

In the last quarter of 2023, US shale gas production increased again. This has been happening for four quarters in a row. Total average daily production reached a record 82.16 billion cubic feet per day, up 1.8% from the prior quarter.

US average daily production of shale gas and tight oil

Source: U.S. Energy Information Administration

Total tight oil production in 2023Q4 fell for the first time in recent years to 8.24 from 8.42 million barrels of oil per day in 2023Q3. However, statistics show the traditional slowdown in production growth or even a decline in the fourth quarter of each year.

Additional information on the state of the shale gas and tight oil production sector in the United States can be obtained based on the quarterly reports of some significant companies operating in this sector. Traditionally, we talk about EOG Resources Inc., Devon Energy Corporation and Occidental Petroleum Corporation.

EOG Resources

EOG Resources, Inc. completed the fourth quarter with record hydrocarbon production in 2023. Total Crude Oil Equivalent was fixed at 1026.2 MBoed, against 909.1 Mboed in the same quarter a year earlier.

EOG Resources, Inc. is one of the largest crude oil and natural gas exploration and production companies in the United States, most of which is shale gas and tight oil. EOG Resources operates primarily in the U.S. in in areas of operations such as Eagle Ford, Permian Basin, South Texas and many others, as well as in Trinidad.

EOG Resources. Revenue, net income and share price

Source: based on EOG Resources

In 2023Q4, Total Revenue EOG Resources reached 6357, and Net Income 1988 millions of USD. In general, in accordance with the above chart, after the peak financial indicators in 2022Q3, there was a slight decrease in them. On the other hand, this was accompanied by an increase in physical indicators of hydrocarbon production. According to Ezra Yacob, Chairman and Chief Executive Officer, "...EOG's business has never been better and its financial position has never been stronger...".

Devon Energy

Devon Energy Corporation is one of the largest independent energy companies in the United States. The company has a first-class portfolio of oil and natural gas assets. At the end of 2022, reserves totaled 1,815 MMBOE of which oil accounted for 44%. Devon operates in five major regions - Delaware Basin, Eagle Ford, Anadarko Basin, Powder River Basin and Williston Basin. The Delaware Basin is the most productive of these regions. Devon is headquartered in Oklahoma City.

The company finished 2023 with good financial and production performance. Total production increased by 8% compared to last year. In the fourth quarter, production exceeded the high end of the guidance range at 662,000 barrels of oil equivalent per day.

Devon Energy. Revenue, net income and share price

Source: Based on Devon Energy Corporation

Devon Energy Corporation's Total Revenue in 2023Q4 was 4145 millions of USD, which is the highest quarterly value in 2023. Net earnings in the last quarter were also the highest and amounted to 1152 million of USD.

Occidental Petroleum Corporation

Occidental Petroleum Corporation (Oxy) is an American oil and gas production company headquartered in Houston, Texas. The company operates in the USA (Permian, Gulf of Mexico, Rockies), the Middle East (Oman, Qatar, United Arab Emirates) and Colombia.

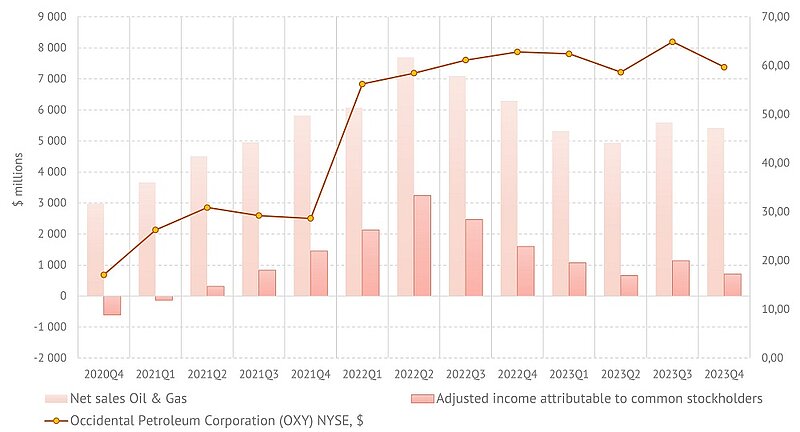

Total US daily production of Oxy in 2023 amounted to 1000 MBOE/D versus 937 a year earlier and in the same units. However, the company's annual financial performance in 2023 is very different from last year ($ millions):

Total Revenue – 28,918 (2023); 37,095 (2022); 7,529 (2023Q4); 8,326 (2022Q4);

Net Income – 3,773(2023); 12,504 (2022); 1,029 (2023Q4); 1,727 (2022Q4);

This imbalance of indicators is obviously primarily related to the difference in product prices. So in 2022, the average annual Worldwide oil price was 94.36 $/bbl, and in 2023 – 76.85 $/bbl, i.e. almost 20% lower.

Occidental Petroleum Corporation. Revenue, net income and share price

Source: Based on Occidental Petroleum Corporation

Several more important achievements of the company noted in the press release at the end of the year:

- Worldwide year-end proved reserves of 4.0 billion BOE with reserves replacement of 137%;

- Increased quarterly dividend by 22% to $0.22 per share;

- Closed acquisition of Carbon Engineering, enabling cost and capital efficiencies and the ability for

Occidental to catalyze broader partnerships for Direct Air Capture deployment.

Thus, from the data presented, we can conclude that the past year ended successfully in the shale gas and tight oil production sector in the USA. This is evidenced by data on physical production volumes and financial indicators of individual companies. However, the events of the next two years may significantly change the current idyllic picture. The US presidential elections are ahead, many are predicting a decline in business activity in Europe, a slowdown in manufacturing growth in China...

By the Editorial Board