Aenert news. Energy Companies

Halliburton, Schlumberger and Baker Hughes are the largest oilfield services companies operating throughout the world. We traditionally present comparative quarterly performance indicators of these companies, as this largely demonstrates the state of the entire oil and gas industry. Each of them specializes mainly in the development of highly efficient technologies and equipment for oil and gas exploration and production, decarbonization of the industry, as well as ensuring a sustainable energy future. Global oil and gas service companies show the most sensitive reaction to the state of the fossil fuel industry, as they have to strike a balance between strong demand for innovative services during expansion of oil and gas production and its massive decline during another renewable energy boom or overproduction crisis. In addition, each of these companies possesses technologies related to the development of the most complex fossil resources, including the latest exploration techniques, directional drilling & hydraulic fracturing, deepwater drilling, steam or gas injection, water flooding, chemical stimulation and much more.

Halliburton

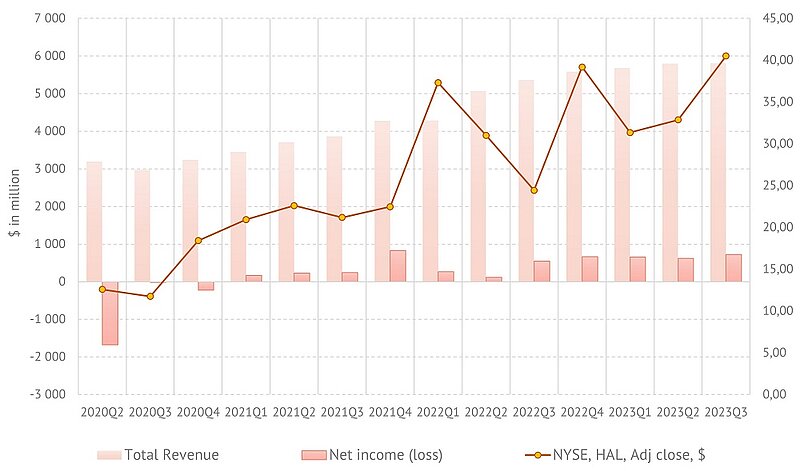

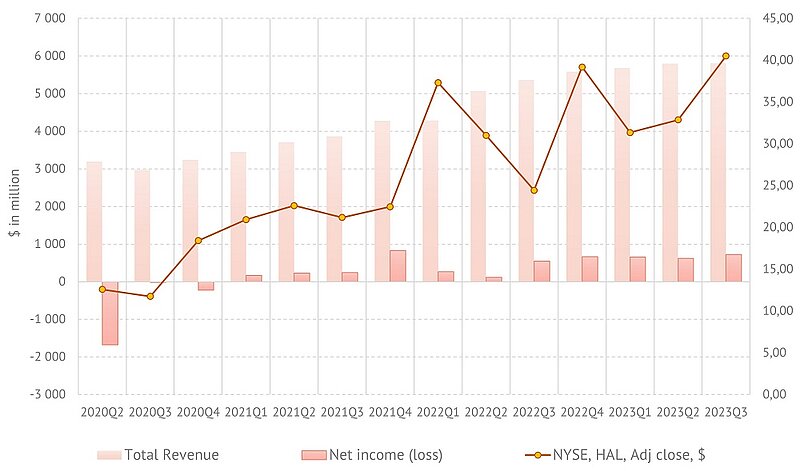

In the third quarter of this year, Halliburton delivered an operating margin of nearly 18% on revenue of $5,804 million. Net income amounted to $724 million. This is significantly higher than the same indicators in the third quarter of last year. Overall, over the past four quarters, the company's revenue growth has slowed, and quarterly profits have stabilized. Income from the activities of the Completion and Production & Drilling and Evaluations divisions was divided 60/40.

Halliburton Company. Revenue, net income and share price

Source: Halliburton

During 2023 Q3 Halliburton introduced: Obex EcoLock®, a new compression-set packer that helps prevent sustained casing pressure; Intelevate™, a new data science-driven platform that helps operators design, build, and operate end-to-end electrical submersible pump (ESP) monitoring solutions, as well as other technological innovations.

The company's share price as of the end of the quarter reached its highest level in recent years.

Schlumberger

For Schlumberger, the third quarter was perhaps the most successful in the last three years, after emerging from the crisis of 2020. Revenue again exceeded $8 billion ($8,310 million), up 11% year-on-year and 3% higher than in the previous quarter. Adjusted EBITDA margin was a generous 25%. Net income attributable to SLB, excluding charges & credits $1,123 million. Revenue by Geography amounted to $6,614 (79.6%) for the International sector, and $1,643 million for North America.

Schlumberger Limited Company. Revenue, net income and share price

Source: Schlumberger

SLB CEO Olivier Le Peuch commented, “Overall, our third-quarter pretax segment operating margin expanded 73 bps sequentially. We also generated strong cash flow from operations of $1.68 billion and free cash flow of $1.04 billion. I want to thank the SLB team for delivering these impressive results.”

Aerial view of hydraulic fracture set in reservoir. Envato. RKJUV7BZ6L

Baker Hughes

Baker Hughes also followed its major competitors in delivering excellent financial performance in the 3 quarter of 2023. Revenue of $6.64 billion for the quarter, up 24% year-over-year. Net income attributable to Baker Hughes Company of $518 million for the quarter, up $534 million year-over-year. Adjusted EBITDA of $983 million for the quarter, up 8% ещ 2023Q2.

Baker Hughes Company. Revenue, net income and share price

Source: Baker Hughes

According to the company's press release, in the third quarter agreements were reached on the implementation of several large business projects: “The OFSE business segment secured a significant contract from a sub-Saharan African operator for subsea equipment in its Subsea & Surface Pressure Systems (SSPS) product line offshore Angola.

OFSE also saw continued regional growth in the North Sea with two major multi-year contracts from Vår Energi.

During the third quarter, OFSE also booked several major awards from a Middle East operator, including a long-term directional drilling services contract spanning the entirety of the customer's oil and gas rigs both on- and offshore.

The IET business segment's third quarter orders confirmed Baker Hughes' continued strength in the natural gas and LNG growth cycle with several awards for gas technology equipment and services”.

Judging by the data presented, the market has good prospects for maintaining and even further developing oil and gas production in the coming years. Of course, these materials do not fully reflect all the aspects that determine market behavior, but their impact on the market cannot be ignored either.

By the Editorial Board

Halliburton, Schlumberger and Baker Hughes are the largest oilfield services companies operating throughout the world. We traditionally present comparative quarterly performance indicators of these companies, as this largely demonstrates the state of the entire oil and gas industry. Each of them specializes mainly in the development of highly efficient technologies and equipment for oil and gas exploration and production, decarbonization of the industry, as well as ensuring a sustainable energy future. Global oil and gas service companies show the most sensitive reaction to the state of the fossil fuel industry, as they have to strike a balance between strong demand for innovative services during expansion of oil and gas production and its massive decline during another renewable energy boom or overproduction crisis. In addition, each of these companies possesses technologies related to the development of the most complex fossil resources, including the latest exploration techniques, directional drilling & hydraulic fracturing, deepwater drilling, steam or gas injection, water flooding, chemical stimulation and much more.

Halliburton

In the third quarter of this year, Halliburton delivered an operating margin of nearly 18% on revenue of $5,804 million. Net income amounted to $724 million. This is significantly higher than the same indicators in the third quarter of last year. Overall, over the past four quarters, the company's revenue growth has slowed, and quarterly profits have stabilized. Income from the activities of the Completion and Production & Drilling and Evaluations divisions was divided 60/40.

Halliburton Company. Revenue, net income and share price

Source: Halliburton

During 2023 Q3 Halliburton introduced: Obex EcoLock®, a new compression-set packer that helps prevent sustained casing pressure; Intelevate™, a new data science-driven platform that helps operators design, build, and operate end-to-end electrical submersible pump (ESP) monitoring solutions, as well as other technological innovations.

The company's share price as of the end of the quarter reached its highest level in recent years.

Schlumberger

For Schlumberger, the third quarter was perhaps the most successful in the last three years, after emerging from the crisis of 2020. Revenue again exceeded $8 billion ($8,310 million), up 11% year-on-year and 3% higher than in the previous quarter. Adjusted EBITDA margin was a generous 25%. Net income attributable to SLB, excluding charges & credits $1,123 million. Revenue by Geography amounted to $6,614 (79.6%) for the International sector, and $1,643 million for North America.

Schlumberger Limited Company. Revenue, net income and share price

Source: Schlumberger

SLB CEO Olivier Le Peuch commented, “Overall, our third-quarter pretax segment operating margin expanded 73 bps sequentially. We also generated strong cash flow from operations of $1.68 billion and free cash flow of $1.04 billion. I want to thank the SLB team for delivering these impressive results.”

Aerial view of hydraulic fracture set in reservoir. Envato. RKJUV7BZ6L

Baker Hughes

Baker Hughes also followed its major competitors in delivering excellent financial performance in the 3 quarter of 2023. Revenue of $6.64 billion for the quarter, up 24% year-over-year. Net income attributable to Baker Hughes Company of $518 million for the quarter, up $534 million year-over-year. Adjusted EBITDA of $983 million for the quarter, up 8% ещ 2023Q2.

Baker Hughes Company. Revenue, net income and share price

Source: Baker Hughes

According to the company's press release, in the third quarter agreements were reached on the implementation of several large business projects: “The OFSE business segment secured a significant contract from a sub-Saharan African operator for subsea equipment in its Subsea & Surface Pressure Systems (SSPS) product line offshore Angola.

OFSE also saw continued regional growth in the North Sea with two major multi-year contracts from Vår Energi.

During the third quarter, OFSE also booked several major awards from a Middle East operator, including a long-term directional drilling services contract spanning the entirety of the customer's oil and gas rigs both on- and offshore.

The IET business segment's third quarter orders confirmed Baker Hughes' continued strength in the natural gas and LNG growth cycle with several awards for gas technology equipment and services”.

Judging by the data presented, the market has good prospects for maintaining and even further developing oil and gas production in the coming years. Of course, these materials do not fully reflect all the aspects that determine market behavior, but their impact on the market cannot be ignored either.

By the Editorial Board