Aenert news. Energy Companies

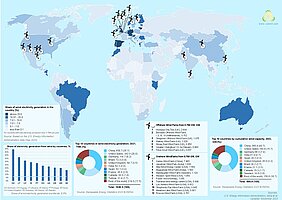

Wind power is a critical tool in the transition from fossil fuels to carbon-free energy. In a number of large countries, for example, Germany, Great Britain, Spain, the share of wind energy in total electricity generation exceeds 20%. In Denmark this share is close to 50%.

Between 2013 and 2022, wind power capacity tripled. By the beginning of 2023, the main capacities of wind generators were concentrated in the three largest economic regions - China (40.7%), Europe (26.8%) and USA (15.7%). The most dynamic development of wind power engineering took place in China, where more than 300 GW of wind turbines were installed within the last ten years, including a record-breaking 72.5 GW in 2020.

Recently, the wind energy industry has faced a number of logistical, technological and financial difficulties, which have had a noticeable impact on production performance. In previous issues, we noted emerging signs of financial instability in a number of leading wind turbine manufacturers. Judging by the results of the latest quarterly reports, this process has not yet received a clear turn for the better.

Goldwind

Goldwind is one of the largest wind energy companies in the world. Goldwind has been the first manufacturer of wind turbines in China for 12 years in a row and has been among the top three companies in this profile in the world for 8 years in a row. The company's total installed wind turbine capacity has reached 111 GW and more than 49,000 turbines. The company operates in 38 countries, but its main market remains China. Goldwind has over 6,700 Domestic and foreign patent applications & more than 4,600 authorized patents.

China is the world leader in terms of installed capacity and electricity generation from wind turbines

The company's total revenue in the 3rd quarter of this year decreased by about a third compared to the previous quarter and amounted to 10,318 million RMB (9,500 million RMB in 2022Q3). Gross Profit Margin amounted to 18.7%.

Goldwind. Revenue, net income and share price

Moreover, after a stunning profit in the first quarter, the last two quarters of 2023 saw profits recorded at minimum values. If we compare the first three quarters of 2022 and 2023, we can find that the total profit for these periods fell from RMB 2,365 to RMB 1,261 (million). Moreover, this is happening against the background of a significant decline in the value of the company’s shares, which has continued for the fifth quarter in a row. I would not like to believe that Goldwind was influenced by negative trends in wind energy, but judging by the data presented, this process did not bypass the company.

One of the positive, if not outstanding, achievements of the company in the third quarter of this year was the construction in September of a record 185-meter wind turbine, approximately the height of a 60-story building. In addition, Goldwind's hybrid steel-concrete tower technology was used. According to the company, such a wind turbine is capable of generating 8.38% more electricity than a 160-meter turbine.

In August 2023, the company launched the jack-up wind turbine installation vessel Goldwind Offshore "ZTT 31" with a displacement of 1,600 tons. The vessel's platform is 139.1 meters long and 50 meters wide, with a maximum lifting height of 165 meters above the main crane deck. At the same time, it is possible to raise offshore wind turbines with a unit power of 20 MW and a working wheel diameter of more than 320 meters, which opens up broad prospects for the development of offshore wind energy.

Vestas

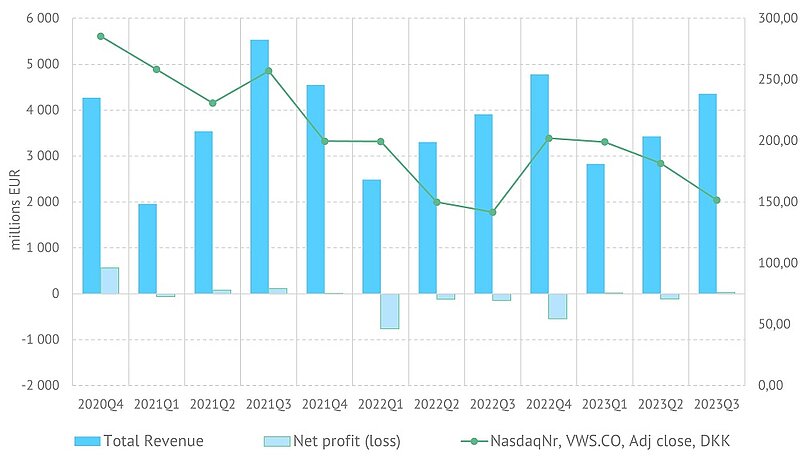

Vestas is the undisputed world leader in total installed wind turbine capacity, which exceeded 173 GW. Over the past two years, the company has been in serious trouble, which has led to significant losses and a decrease in the order book. In the third quarter of this year, financial indicators remained at an unsatisfactory level, however, the volume of orders increased significantly. If in 2022Q3 it was 1895 MW, then a year later it was 4502 MW.

Vestas. Revenue, net income and share price

This gives reason to hope that the company's period of failure is over and a return to its previous stable and positive results should be expected in the near future. An additional driver of this process can certainly be the appearance on the market of the company’s new flagship turbine - V236-15.0 MW. Suffice it to say that according to a Vestas press release dated September 29, 2023, 64 turbines of this class with a total capacity of 960 MWt were ordered for the North Sea project alone. In addition, for the Baltic Power Offshore Wind project in Poland, ORLEN S.A. and Northland Power Inc. another 1,140 MWt has been ordered. Of course, such huge orders will help Vestas emerge from the protracted crisis.

GE renewable energy

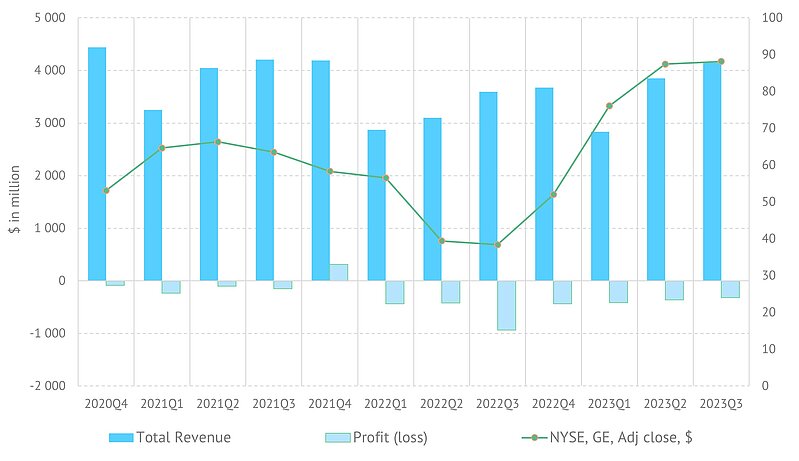

The renewable energy division of GENERAL ELECTRIC COMPANY is primarily involved in the production of wind turbines and is supported by other more profitable divisions of the companies (Aerospace and Power).

In the third quarter of 2023, GE Renewable Energy's loss was $317 million, significantly less than the record figure for the same quarter last year ($934 million).

GE Renewable Energy. Revenue, net income and share price

The company receives its main income from the sale of equipment; the share of services is approximately six times less. In 2023Q3, GE Renewable Energy produced 666 wind turbines (2.5 GW), slightly higher than the same quarter last year. The rapid and fairly significant growth of the company's shares over the previous three quarters ended in the current quarter, demonstrating virtual independence from financial indicators.

By the Editorial Board