Aenert news. Energy Companies

The solar photovoltaics market continued its rapid development in the second quarter of 2023. According to the company, Longi global annual growth in the first half was 45%. The greatest dynamics were demonstrated by China, where almost 74.5 GW solar power capacity was installed during this period, up by 154% of the same period of 2022. Brazil, Germany and the USA also saw a significant increase in installed photovoltaic capacity.

Below is a summary of the financial and operating results of PV industry leaders from around the world for the second quarter of 2023 (2023Q2). The total share of sales of solar modules from the represented companies was approximately 12% of the global total. At the same time, the Chinese Longi is the world leader in the production of monocrystalline solar cells. First Solar specializes in the production of thin film PV modules with a layer of Cadmium Telluride (CadTel) semiconductor. Jinko Solar has consistently ranked among the world's top five solar panel manufacturers for many years, and Canadian Solar is North America's largest manufacturer.

Longi

Longi's total revenue in the second quarter of 2023 was RMB 36.33 billion, an increase of more than 28% compared to the first quarter this year. Net profit attributable to shareholders of the listed company increased by 52.35% to 5.54 billion RMB. Cell and module shipments reached 17.32 GW (37.5% increase compared to 2023Q1).

However, the company's strong financial performance was not supported by the stock market. According to Longi's share price data at the end of each quarter, the decline in its capitalization has continued throughout the year.

Longi. Revenue, net income and share price

As of the end of 2023Q2, Longi had accumulated more than 2,500 patents. Among the results of the company's research activities is the development of perovskite/crystalline tandem solar cells, the efficiency of which has reached 33.5%. Also in the first half of 2023, the company began production of HPBC (Hybrid Passivated Back Contact) solar cells, which reached their design capacity.

Spain. Solar PV power plants. Aenert photos

First Solar Inc.

The second quarter of 2023 was one of First Solar's strongest quarters. Sales were $811 and net income was $171 millions. In the same quarter last year, these figures were as follows - $621 and $56 million, respectively. In 2023Q2, the company produced 2.4 GW of solar modules of the sixth series and 425 MW of the updated seventh series. The intensive growth in the company's share price over the previous three quarters has slowed down slightly.

First Solar. Revenue, net income and share price

Among the important events for the company in the second quarter, we should highlight the completed construction of the India facility, limited production run of our first thin film bifacial solar panel, and acquired Evolar, a European leader in perovskites and CIGS thin film technology.

Jinko Solar Holding Co.Ltd.

Jinko Solar delivered perhaps its best quarterly results in the second quarter of 2023. Total module shipments reached 17763 MW (+36.2% to 2022Q2), Revenue was at $4231 million (+31.5%), and net income $180 million (+65.6%). The company's share price fell slightly.

Jinko Solar. Revenue, net income and share price

Gross profit increased to a record $660 million and Gross margin was fixed at 15.6%. The company forecasts sales growth in the third quarter of this year in the range of 19.0 – 21.0 GW.

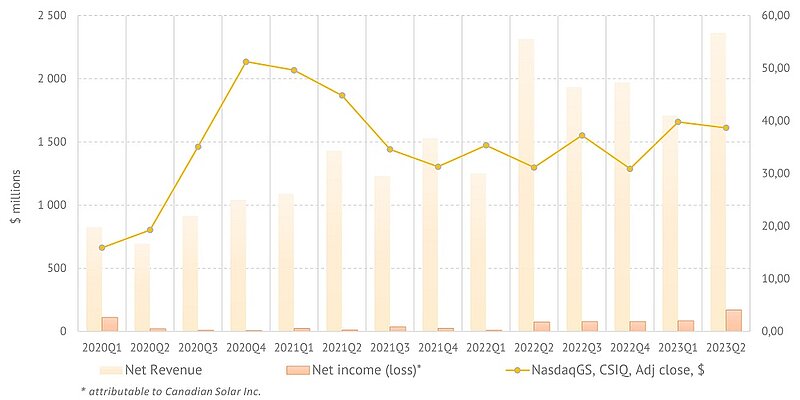

Canadian Solar

This company also presented several record figures. So net income attributable to Canadian Solar in 2023Q2 amounted to $170 million versus $74 million in the same quarter last year. 62% increase in solar module shipments year-over-year to 8.2 GW. Net revenue increased by 39% to $2,364 million.

Canadian Solar. Revenue, net income and share price

The quarterly price of the company's shares has been in a relatively narrow range for the seventh quarter in a row.

In the second quarter of this year, the company continued mass production of its flagship N-type TOPCon Bifacial Module with a twelve-year warranty on materials and workmanship and a thirty-year warranty on linear power output.

Thus, based on the presented materials, we can make a reasonable conclusion about the confident development of the photovolatic segment of solar energy. This contrasts markedly with the second quarter 2023 results for leading wind turbine manufacturers, as we reported in our recent issue.

By the Editorial Board