Aenert news. Energy Market & Energy Statistics

Electric cars are taking an increasingly important place in the global vehicle market. Over the past three years, there has been a real breakthrough in this sector. The year 2021 was particularly successful in this respect, with an increase in sales of more than 100%, according to Global EV Sales for 2022. In 2022, according to the same source, sales increased another 50% to 10.5 million units, representing about 13% of the global market for new vehicles. Especially remarkable was the breakthrough of China, where sales growth amounted to more than 80%. The performance in the U.S. and Europe was less strong, but still it was much better than in the sluggish conventional light vehicle markets. Thus, according to the European Automobile Manufacturers’ Association, the cumulative share of all new types of electric vehicles, including hybrids significantly exceeded 40% in Europe in 2022, thus overtaking traditional gasoline or diesel cars. Preliminary data on sales of electric vehicles in the first two months of this year suggest that the positive trend may continue this year. In Europe, the largest percentage of new electric vehicles is registered in Norway, Iceland and Sweden.

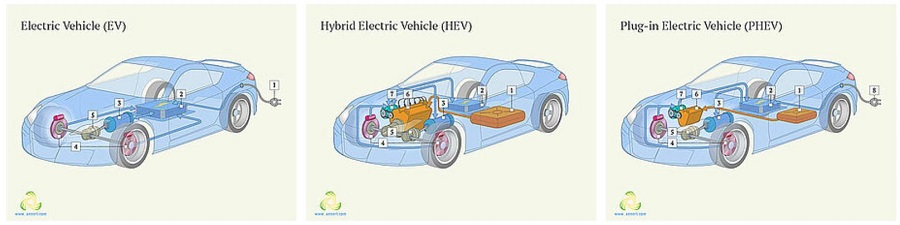

There are several types of electric vehicles, the main ones of which are shown in the figure below.

1. Power cord or Fuel storage 2. Lithium-Ion battery system 3. Electric motor 4. Regenerative braking 5. Transmission 6. Engine 7. Generator 8. Power cord

At present, the long-term prevalence in the HEV market is steadily shifting towards BEVs and PHEVs. This is especially noticeable during periods of rising gasoline prices. For example, Argonne’s Center for Transportation Research reports that in February 2023 sales of HEVs in the U.S. amounted to just over 60 thousand, while in the BEVs and PHEV segment over 174 thousand units in total were sold. Judging by the level of sales, the advantage of electric cars over the hydrogen fuel cell electric vehicle (FCEV) becomes even more obvious. According to the same source, only 504 FCEVs were sold in the U.S. in 2023, and since 2014 their number has been less than 15.5 thousand units.

These impressive results of electric car production growth, especially compared to other sectors of the economy, which underwent a significant decline during the period of COVID-related restrictions, must be duly attributed to the production companies. However, these results cannot be unambiguously applied to all market players and all regions. It is a fact that at each stage of the technological chain the production of vehicles is extremely sensitive to transport and sales logistics, timely supply of components, currency fluctuations, etc. These problems, which are ever-present on the agenda, have been greatly exacerbated by the conflict in Ukraine.

In addition, by the end of last year, the situation in the lithium battery production segment was extremely unstable. We have previously reported that in November 2022, the price of lithium carbonate came close to 600,000 yuan per tonne (CNY/T), up from less than 50,000 CNY/T in mid-2020. And, although by the end of February 2023, prices had fallen to less than 400,000 CNY/T, market tensions remain.

In this regard, it is useful to look not only at the general statistics of the industry, but also at the financial results of the companies active in this industry. For this purpose, we have selected three companies having different business sizes which specialize in the production of electric cars and are listed on international stock exchanges. One of them is the industry leader, the American Tesla; the second is China's Li Auto, which is one of the top 10 local manufacturers; and the Swedish Polestar, which is gradually increasing its presence in the market.

Tesla

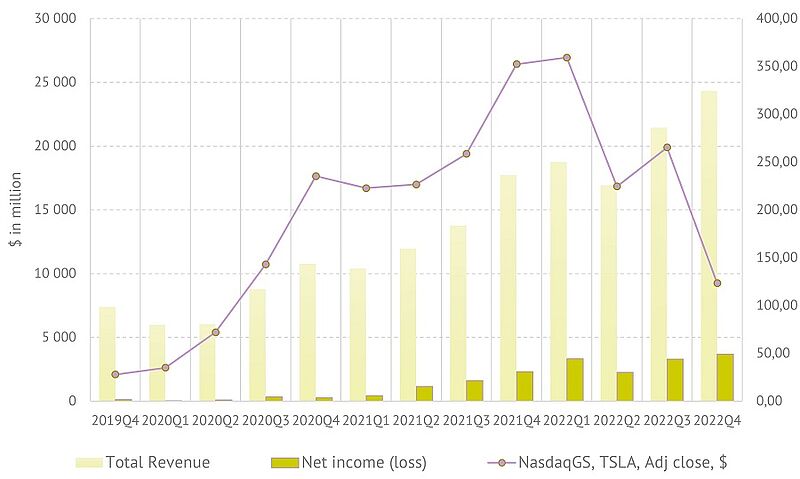

2022 was the most productive year for the company. More than 1.3 million BEVs were delivered to the market, which was an absolute record. Automotive revenues in 2022 reached almost $71,462 million, compared to $47,232 million a year earlier (51% growth). Net income attributable to common stockholders (GAAP) was $12,556 million ($3,687 million in the fourth quarter of 2022). Over the last three years, Tesla's sales, revenues, gross margin and net income increased quarter over quarter. In the fourth quarter, sales were up 4% over the previous quarter to more than 405,000. By comparison, just over 100,000 electric cars were produced in 2019Q4. In addition, the company is actively increasing production of the Solar Roof and various accessories.

The company currently produces the following BEV models - Model S, Model X, Model Y and Model 3. The last two models are now the most popular on the market. Several new models will be released in the market this year. Among the company's recent technological advances is the transition to lithium-iron-phosphate (LFP) batteries. Despite the lower power capacity, LFP is safer and cheaper than its predecessors.

Tesla Company. Revenue, net income and share price

However, the company's operation is not trouble-free. The difficulties with the Tesla Gigafactory Shanghai lockdown in the second quarter of 2022 demonstrated how vulnerable global production is. Recently, China's BYD (Build Your Dreams) has been ramping up production at a gigantic pace and appears to have surpassed Tesla in total electric vehicle production, albeit by a combination of BEVs and PHEVs. A certain uncertainty is also created by the rapid decline in the company's shares after the peak values in the second half of last year.

Nevertheless, Tesla has for many years deservedly remained the leader in production of electric cars and the most recognizable brand on the market.

Li Auto

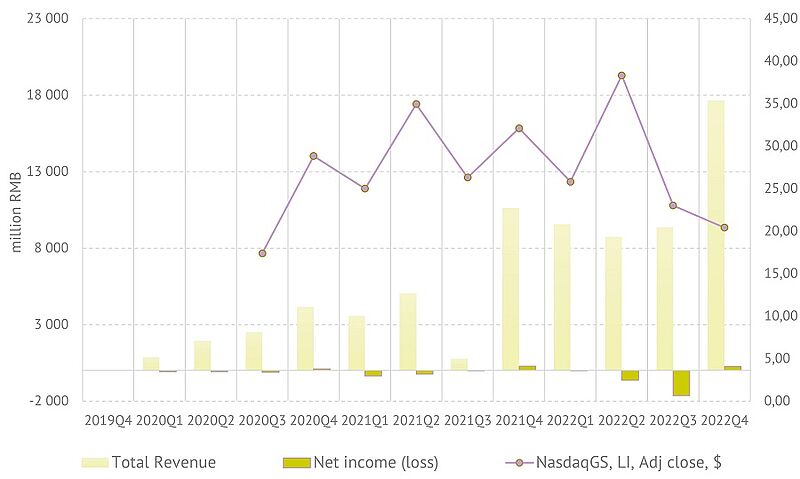

China's Li Auto Inc. (Li Xiang) specializes in the production of premium PHEVs with extended range. The company's products are presented mainly in the domestic Chinese market. Li Auto's lineup includes a number of family SUVs, such as the Li L9, Li L8, Li L7 and Li ONE. The company entered the market in 2019 and was listed on the Nasdaq in 2020, and by the end of 2022 it sold more than 250 thousand of its electric vehicles. The fourth quarter of 2022 was particularly productive for the company, with more than 46,000 SUVs delivered to the market (+31.5% over 4Q2021). Total 2022 sales were up 47.2% year-over-year to 133,246 units. According to CleanTechnica, Li Auto ranked among the top 10 suppliers among BEVs and PHEVs in January this year, selling just over 14,000 of its Li L9 and Li L8 models. By comparison, Tesla delivered nearly 100,000 of its Model Y and Model 3 over the same period.

In 4Q2022 total revenues were RMB17.65 billion (US$2.56 billion) (+66.2%), net income was RMB265.3 million (US$38.5 million). It was a decrease of 10.2% from RMB 295.5 million in the fourth quarter of 2021, compared with RMB1.65 billion net loss in the third quarter of 2022.

Li Auto Inc. Revenue, net income and share price

The data in the figure above, despite the limited information, shows that the financial development of the company does not go smoothly. There are problems with reaching a sustainable profit. The second and the third quarters of the current year were unsuccessful for the company. On the other hand, almost all electric car manufacturers experienced similar difficulties, and the current positive market dynamics will inevitably contribute to good financial results.

Li Auto L9. JustAnotherCarDesigner. CC BY-SA 4.0

The company's technical concept is based on the Extended Range Electric Vehicle technology, where the combustion engine drives the generator rotor, which in turn continuously recharges the batteries. This provides the vehicle with an extended range.

Among the important engineering innovations of the company, a high-voltage all-electric platform (800V) and the development of full-stack technologies with regard to power chips, power modules, electronic controllers, motors, and transmission systems should be highlighted. Moreover, Li Auto has created the Range Extended EV 2.0 platform which is a more efficient, quieter and more integrated electric drive system, as well as the Smart Space based on multi-modal 3D spatial interaction technology and development in-house in regard to smart driving.

Polestar

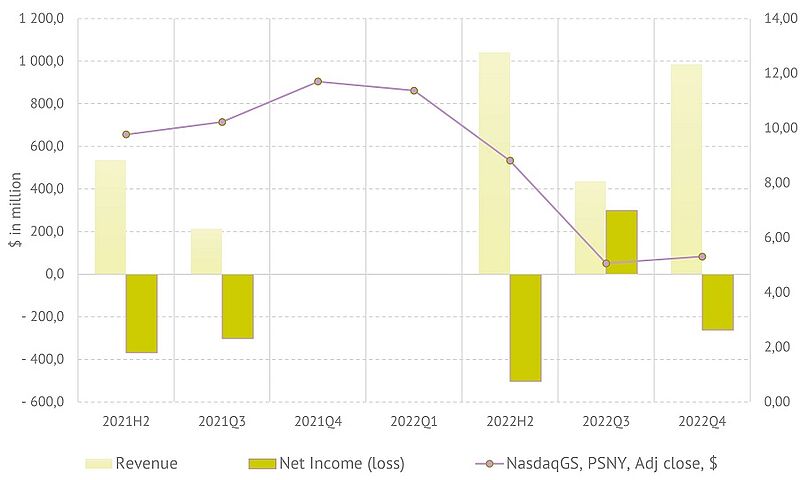

The Swedish company Polestar, headquartered in Gothenburg, was founded in 2017. The company is manufacturing in two facilities in China, with additional future manufacturing planned in the USA. The company supplies three models to the market – Polestar 1,2,3. The technological asset of the company includes – carbon fiber body and electric-only range of 124 km, the longest of any hybrid car in the world (Polestar 1); all-electric high-capacity car (Polestar 2); electric performance SUV (Polestar 3); smaller electric performance SUV coupe (Polestar 4).

In 2022, the company's sales increased by a staggering 80% to 51,491 units. Polestar also expanded its presence in eight additional countries, including the United Arab Emirates, Kuwait and Hong Kong. Total revenue was $2.5 billion in 2022, an increase of 84% over last year. Gross margin (%) was 4.9% versus 0.1% in 2021. At the same time, Adjusted operating loss was more than $900 million, slightly less than a year earlier, indicating the company's challenging business development. In addition, research and development expenses decreased by 27%. Obviously, this was caused by a serious drop in the value of the company's shares last year. The company explains growth of Operating loss of more than $290 million as "... impacted by a Q2 2022 one-time share-based listing charge of USD 372.3 million".

Polestar. Revenue, net income and share price

The company's program for 2023 however is impressive – sales of electric cars are expected to increase by 60% to 80,000 units. Polestar hopes to make an even bigger leap in the coming years when Polestar 3 and Polestar 4 hit the market. In addition, the company will continue to seek proposals for raising additional capital to finance operations and business growth.

Polestar Precept - a vision of the brand's future direction and execution of new, more sustainable interior materials, the continued development of the digital user interface and the essence of Polestar design

Among the company's latest developments scheduled for implementation are the following:

- “…Google’s new HD map that will debut in Polestar 3, and the roll-out of remote actions for Polestar 2”;

- Polestar 3 “…together with Smart Eye, supplier of premium driver monitoring technology which is included as standard”;

- “…Polestar 3 - substantial performance increases with all-new electric motors, even more powerful batteries, longer range, sustainability improvements and, for the first time in a Polestar, rear-wheel drive”;

- Joint ventures for the implementation of the ambitious Polestar 0 project to create a truly environmentally neutral car by 2030.

By the Editorial Board