Suncor is an integrated energy company headquartered in Calgary, Alberta, Canada. The company is focused on developing one of the world's largest petroleum resource basins – Canada's Athabasca oil sands. Suncor explores, acquires, develops, produces and markets crude oil and natural gas in Canada and internationally. The Company transports and refines crude oil, markets petroleum and petrochemical products, primarily in Canada. The company also conducts energy trading activities, focused principally on the marketing and trading of crude oil, natural gas, power and byproducts. Suncor also operates a renewable energy business as part of its overall portfolio of assets.

Suncor has classified its operations into the following segments: Oil Sands; Exploration and Production; Refining and Marketing; and Corporate, Energy trading and Elimination.

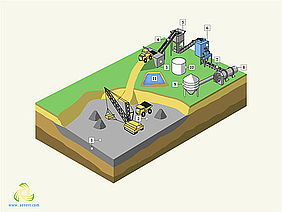

Suncor's Oil Sands segment recovers bitumen from mining and either upgrades this production into SCO for refinery feedstock and diesel fuel, or blends the bitumen with diluent for direct sale to market.

Exploration and Production (E&P) includes offshore activity in East Coast Canada, with interests in the Hibernia, Terra Nova, White Rose and Hebron oilfields, the exploration and production of crude oil and natural gas at Buzzard and Golden Eagle Area Development, as well as development of the North Sea Rosebank Project, all in the United Kingdom, and the development of the Oda and Fenja fields in Norway, and in Libya and Syria.

Suncor's Refining and Marketing segment consists of two primary operations: Refining and Supply operations, which refine crude oil into a broad range of petroleum and petrochemical products, and Marketing operations, which sell refined petroleum products to retail, commercial and industrial customers.

The grouping Corporate, Energy Trading and Eliminations includes the company's investments in renewable energy projects, results related to energy marketing, supply and trading activities. Renewable Energy investment activities include development, construction, and ownership of Suncor-operated and joint venture partner-operated renewable power facilities across Canada. This includes wind power facilities located in Alberta, Saskatchewan and Ontario, as well as optioned lands for future wind and solar power project development. Energy Trading activities involve the marketing, supply and trading of crude oil, natural gas, power and byproducts.

According to the Annual Financial Report Revenue from the sale of crude oil, natural gas, natural gas liquids, purchased products and refined petroleum products amounted to $38.542 billion in 2018 and represented an increase of 21% from $31.954 billion in 2017.

Suncor's consolidated operating earnings in 2018 were $4.312 billion, compared to $3.188 billion in 2017 and an operating loss of $83 million in 2016. The increase was primarily due to improved overall crude pricing, increased refining margins, higher production, primarily attributed to Fort Hills and Hebron, and the increased working interest in Syncrude, acquired in early 2018, as well as improved energy trading earnings. These factors were partially offset by an increase in expenses associated with the expansion of the company's production in 2018, an increase in maintenance expenditures at Syncrude and Oil Sands operations. Operating losses in 2016 were significantly impacted by the shut-in of production associated with the forest fires in the Fort McMurray area.

Net earnings for 2018 were $3.293 billion, compared to $4.458 billion in 2017 and to $445 million in 2016, impacted by the same factors that influenced operating earnings, which are described above. Other items affecting net earnings in 2018 and 2017 included the after-tax unrealized foreign exchange loss of $989 million in 2018, compared to a post-tax gain of $702 million in 2017.

In 2018, Suncor achieved record consolidated funds from operations of $10.172 billion, compared to $9.139 billion in 2017, and to $5.988 billion in 2016, impacted by improved overall crude pricing, increased refining margins, higher production and improved energy trading earnings.

Cash flow provided by operating activities was $10.580 billion in 2018, compared to $8.966 billion in 2017 and $5.680 billion in 2016.

ROCE (Return of Capital Employed) improved to 8.0% in 2018, compared to 6.7% in 2017.

A total of $2.333 billion in dividends were paid in 2018, an increase of 12.5% per share compared to 2017, making 2018 the 16th consecutive year of annual dividend increases for Suncor. The company repurchased $3.053 billion of its own shares for cancellation during 2018, compared to $1.413 billion in 2017. Suncor's Board of Directors approved a quarterly dividend of $0.42 per share to be paid in the first quarter of 2019, an increase of 17%.

Segmentally, oil sands production increased to 628,600 bbls/day in 2018, compared to 563,700 bbls/day in 2017. Operating revenues in oil sands operations increased by 19% to $15,345 million in 2018 from $12,919 million in 2017. Operating earnings in oil sands operations decreased by 17% to $793 million in 2018 from $954 million in 2017, due to an unfavourable sales mix associated with a decrease in SCO production, lower bitumen price realizations and higher maintenance costs. Funds from operations for the Oil Sands segment were $4.870 billion in 2018, compared to $4.738 billion in 2017. The increase was primarily due to the acquisition of an additional 5% working interest in Syncrude.

Operating revenues in E&P operations increased to $3,217 million in 2018 from $2,911 million in 2017 and $2,231 million in 2016. Net earnings for the E&P segment increased by 10% to $808 million in 2018 from $732 million in 2017, and by 285% from $190 million in 2016. Funds from operations for the E&P increased to $1,869 million in 2018 from $1,725 million in 2017 and $1,313 in 2016.

The Refining and Marketing segment achieved record financial results in 2018, with $3.153 billion in net and operating earnings, compared with $2.164 billion in 2017, and $3.794 billion of funds from operations in 2018 compared to $2.841 billion in 2017. Record results were driven by a favourable business environment, including wider crude oil differentials, and strong refinery utilization in 2018.

Significant results in 2018, as well as reliable cash flow growth for years, have seen Suncor become a leader in sustainability and position the company to be a progressive, cost-efficient and carbon-competitive energy provider.