The Company „Schlumberger“, being a recognized global leader in providing the oil and gas industry with a full range of technologies, generated 2015 a revenue of $ 35,47 billion which represents a drop of 27% respected to 2014 ($ 48,58 billion) according to the Company´s Annual Report for 2015. The main reason of such a revenue drop within the last four years was due to the customer spending falling as the commodity prices weakened within 2015.

The drop of the revenue 2015 in the oil industry was impacted by the OPEC lifting production targets by producing at the maximum rates which led to supply to exceed the increasing demand.

In the contrary the natural gas industry production grew to a record of 75 Bcf/d as new production fields in the US Gulf of Mexico were put into operation and the supplies of unconventional shale gas and tight oil reservoirs continued to grow. This trend is expected to continue with the newly completed pipeline capacity in the northeast US which brings new supplies.

The Company´s income from continuing operation 2015 decreased to $ 2,072 billion which is triple as less comparing to 2013, when it reached $ 6,8 billion. The ratio of income from continuing operation to turnover amounted to 6% in 2015, provided that in 2014 it was at the level of 12% and in 2013 the figure was 15%.

Among the Groups, all segments performances decreased 2015 respected to 2014. The Reservoir Characterization segment performance was indicated by the drop of turnover by more than $ 3 billion and the turnover of the Drilling Group Segment decreased by $ 4,7 billion, impacted mostly by sustained cuts in exploration spending, currency weaknesses, persistent pricing pressure and operational disruptions lowered Drilling & Measurements revenues across all geographies, but most significantly in the Europe, CIS & Africa Area.

Production Group performance with the turnover which is reduced by more than $ 5 billion comparing to 2014 was mainly affected by the fall in North American land activity as exhausted customer budgets led to a continued decline in rig count, numbered less than 700 rigs, and increased pricing pressure.

In spite of falling activity, new technology sales remained robust across all Groups during the year, representing 24% (27% in 2014) of total sales and proving the value that innovative technology can bring when delivered with increased efficiency and higher reliability. The total cost of new technologies and know-how´s slightly increased from $ 1 747 million in 2014 to $ 1 864 in 2015.

Fractional presence of the company in different regions recorded in the North America a drop of 5% from 33% in 2014 to 28% in 2015 while the presence in the Middle East & Asia Area increased by 4% (from 24% in 2014 to 28% in 2015). The presence of the company in other regions 2015 remained unchanged respected to the prior year.

Internationally, the revenue in the Europe, CIS & Africa Area fell by 26% as a result of the weakening Russian ruble, and due to a drop in exploration activities in the North Sea and Sub-Saharan Africa. In Latin America, revenue declined 22% due to decreased activity in Mexico, Brazil, and Colombia as a result of sustained budget cuts that led to rig count reductions. Middle East & Asia Area revenue decreased 17% on lower activity in the Asia Pacific region, particularly in Australia.

R&E expenditure in 2015 totalled $ 1,094 billion or 3,1% of the turnover of the company for the year which is slightly higher than in 2014 being at the level of $ 1,217 billion and 2,5% of the turnover. The prime cost of all the company´s operations and services, and administrative costs were reported as being 79% (77% in 2014) and 1,39% (0,97% in 2014) of the turnover, respectively. The main losses of the company occurred due to the workforce reduction - $ 920 million and to the impairment of fixed assets - $ 776 million. The company value in 2015 slightly increased to $ 15,605 million.

The important announcement in August 2015 was to acquire Cameron International Corporation, the company with which Schlumberger formed the OneSubseaTM joint venture in June 2013. The main reason for that is the technical breakthrough through the integration of Schlumberger downhole reservoir and well technologies with Cameron surface drilling, processing, and flow control technologies to launch a new era of complete drilling and production system performance. The transaction is expected to be close in the first quarter of 2016.

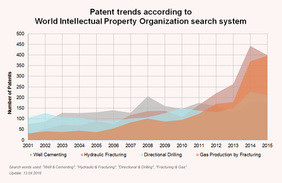

In 2015 the company demonstrated fairly convincing results in innovation activity. Traditionally Schlumberger patent documents refer to various technological areas of enhanced oil and gas production, particularly to directional drilling and hydraulic fracturing, which can be considered as some of the most rapidly developing segments of oil and gas production. According to our estimates, the share of Schlumberger patent documents published in 2015 in this technological segment (including major affiliate companies) comprised almost 11% of the total number of patent documents found in the largest patent offices of the world. Total share of patent applications published by the group of companies is slightly lower – 7% of the total amount of applications. However, growth of this value increased by 20% as compared to the preceding year. By far the most productive companies of the group in the field of patenting activity in 2015 are Schlumberger Technology Corporation, Schlumberger Technology B.V. and Schlumberger Canada Limited.