Aenert news. Energy Companies

Three world leaders with a long history – Halliburton, Schlumberger and Baker Hughes – recently announced their financial results for 2022. Each of them specializes mainly in the development of highly efficient technologies and equipment for oil and gas exploration and production, decarbonization of the industry, as well as ensuring a sustainable energy future.

Global oil and gas service companies show the most sensitive reaction to the state of the fossil fuel industry, as they have to strike a balance between strong demand for innovative services during expansion of oil and gas production and its massive decline during another renewable energy boom or overproduction crisis. It should also be noted that all of these companies have a presence on virtually every continent and in every oil-producing country. In addition, each of these companies possesses technologies related to the development of the most complex fossil resources, including the latest exploration techniques, directional drilling & hydraulic fracturing, deepwater drilling, steam or gas injection, water flooding, chemical stimulation and much more. This is crucial because, on the one hand, fossil resources still account for an overwhelming share of primary energy consumption, and on the other hand, reserves from low permeability plays, unconventional oil, coal bed methane, etc. are becoming increasingly important in the oil and gas reserve balance.

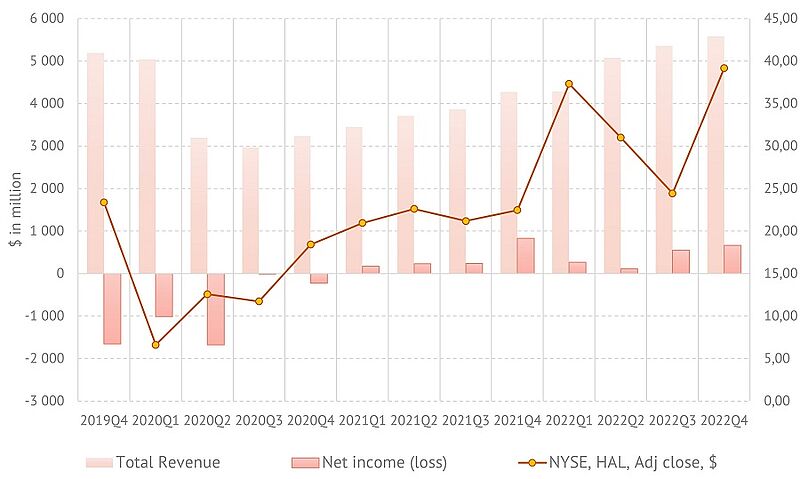

Halliburton Company

After a difficult period in late 2019 and early 2020, accompanied by severe losses, the company was able to restructure its operations and return to sustainable development. Halliburton has seen steady revenue growth and quarterly profit generation over the past two years, accompanied by increases in its share prices.

Halliburton Company. Revenue, net income and share price

In 2022, the company's total revenue increased 33% compared to the previous year to $20.3 billion. In the fourth quarter of 2022, total revenue was $5582 million and net income was $665 million. This is almost 20% less than in the corresponding quarter of 2021, but $116 million higher than in the previous quarter. The revenue mix was dominated by completion and production (57%), with drilling and evaluation accounting for 43%. The company generated the most revenue from its North American operations ($2.6 billion). Internationally, the company was active in Latin America (revenue in the fourth quarter of 2022 was $945 million), Middle East/Asia ($1.4 billion), Europe/Africa ($657 million).

Current technology advances include "...successful installation of the industry's first single trip, electro-hydraulic wet connect in deepwater for Petrobras in Brazil...", "NeoCem™ E+ and EnviraCem™ cement barrier systems" (provides lower carbon emission), the BrightStar service (..."provides reservoir insight of the trajectory ahead and detects changes in formation resistivity, reducing the uncertainty of formation boundary positions”). Other company innovations include FloConnect® Surface Automation Platform, Field Development Planning DecisionSpace® 365 (in cooperation with Aker BP), remotely controlled LOGIX® Autonomous Drilling Platform, 400th FlexRite® - multibranch inflow control (MIC) system installation.

Halliburton is a recognized leader in patenting its developments. According to our calculations, in 10 years, from 2012 to 2021 alone, Halliburton Energy Services, Inc. (US) was granted more than 5,300 patents in directional drilling & hydraulic fracturing, as well as about 800 patents in unconventional oil. Many subsidiaries not included in this data, such as Halliburton Manufacturing & Services Limited (GB), Halliburton Energy Services, Inc. (CA), were also involved in patenting.

Schlumberger

Like Halliburton, Schlumberger Limited Company also showed impressive results in 2022, having successfully emerged from the crisis of early 2020. Total revenue in the past year amounted to $28.1 billion, or 23% more than in the previous year. Net income attributable to SLB reached $3.14 billion for the year, up 71% from 2021. Fourth quarter 2022 revenue was $7.88 billion, up 5% from the prior quarter and 27% from the same quarter in 2021. Net income in 4Q 2022 was the highest compared to other quarters at $1.026 billion.

Schlumberger Limited Company. Revenue, net income and share price

On the stock market, the company has received support from investors, as evidenced by the steady growth in their value in recent years. The main service market for the company is international. So international revenue in 2022 was $21.9 billion against $5.99 billion in North America. Well construction and production systems dominated the main technology segments offered by the company in 2022, with 38% and 29% revenue share, respectively. They were followed by reservoir performance and digital & integration in terms of demand.

Schlumberger is widely represented in the world's major patent offices by numerous affiliated companies. The most productive of them, Schlumberger Technology Corporation (US), was granted at least 170 patents between 2012 and 2021 in areas related to unconventional oil and about 700 patents in directional drilling & hydraulic fracturing.

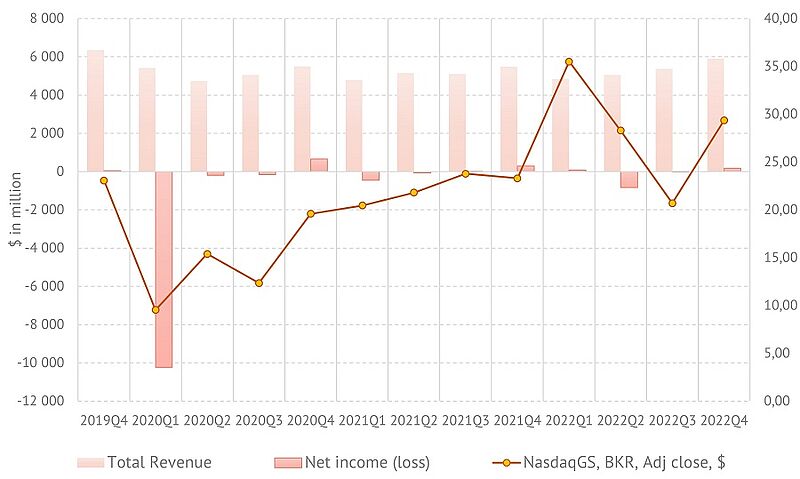

Baker Hughes

Baker Hughes Company is another representative of the world's largest service companies for the oil and gas market. Based on recent financial statements, the company has not yet been able to fully overcome the effects of the extremely hard year of 2020, when the planet was ravaged by Covid-19 pandemic and oil futures contracts plunged to negative marks. In 2022, Baker Hughes generated a revenue of $21.156 billion, a 3% increase over 2021. Net loss attributable to Baker Hughes Company for the same period increased to $601 million, from $219 million a year earlier. It should be noted that in 2020, a year that will be long remembered, the company's losses amounted to about $10 billion. The company's serious financial setbacks in the second quarter of 2022 did not allow to end the year with a profit.

Baker Hughes Company. Revenue, net income and share price

Nevertheless, the results of the last quarter of 2022 are reasonably optimistic. Revenue in the fourth quarter was $5.9 billion, up 10% from the previous quarter and up 8% from a year earlier. Net income attributable to Baker Hughes was $182 million. Perhaps most importantly, however, the company received a record $8 billion in orders in the fourth quarter of 2022, up 32% from the previous quarter and 20% from a year earlier.

Baker Hughes provides services in two main segments – oilfield services & equipment and industrial & energy technology at a ratio of about 60 to 40. In the oilfield services & equipment segment, the product line consists of well construction, completions, intervention & measurements, production solutions, subsea & surface pressure systems. Geographical expansion of the company covers North America, Latin America, Europe/CIS/Sub-Saharan Africa, and Middle East/Asia. North America and Middle East/Asia are the most prolific. The industrial & energy technology segment includes gas technology – equipment, gas technology – services as well as condition monitoring, inspection, pumps, valves & gears, psi & controls. Gas technology was the largest contributor to the $1.5 billion in revenue in the fourth quarter.

Baker Hughes, like the two companies mentioned above, is actively involved in patenting its developments. Between 2012 and 2021, Baker Hughes Incorporated (US) was granted about 1,300 patents in directional drilling & hydraulic fracturing and about 400 patents in unconventional oil.

The financial results of global oil and gas service companies are indirect evidence of investment trends in this industry. Judging by the data presented, as well as by the positive trends in the 2022 rig count statistics, the market has good prospects for maintaining and even further developing oil and gas production in the coming years. Of course, these materials do not fully reflect all the aspects that determine market behavior, but their impact on the market cannot be ignored either.

By the Editorial Board