Ocean Power Technologies was founded in 1984 and is headquartered in New Jersey. The company is the leader in ocean wave power conversion technology. The PB3 PowerBuoy® is the company´s first fully commercial product which generates electricity by harnessing the renewable energy of ocean waves. In addition to PB3 PowerBuoy®, the company continues to develop its PowerBuoy® product line based on modular, ocean-going buoys, which have been periodically tested since 1997. In November 2018, the company announced additional complementary products, the hybrid PowerBuoy® and subsea battery solutions which leverage existing expertise in offshore power systems. The PB3 PowerBuoy® generates power for use in remote offshore locations, independent of a conventional power grid.

In February 2019, the company entered into a contract with the U.S. Navy to carry out the first phase of a project to design and develop a buoy mooring system which incorporates fibre optics for the transmission of subsea sensor data to airplanes, ships, and satellites.

In January 2019, Ocean Power Technologies entered into a Joint System Solution Development and Marketing Agreement with Saab. The agreement anticipates a preliminary focus on AUV and eROV charging and communications systems.

As of June 2019, the company has been issued 66 U.S. patents, of which 47 are active and 18 have expired and 1 was abandoned. Outside of the U.S. Ocean Power Technologies has been issued 237 patents across 13 countries with 37 of the active U.S. patents.

According to the Annual Financial Report, the company has currently two main revenue-producing contracts or customers. These are: ENI in the Adriatic Sea and Premier Oil UK Limited, with the total percentage of revenue of 54% or $341.000 and 33% or $265.000, respectively, which were achieved in 2019. Since its inception, the cash flows from customer revenues have not been sufficient to fund the company´s operations and provide the capital resources for the business. Revenues for the fiscal years ended April 30, 2019, 2018 and 2017 were approximately $0.6 million, $0.5million and $0.8 million, respectively. The increase of approximately $0.1 million or 24% over 2018 was attributable to more new contracts signed and started at the end of fiscal year 2018 and beginning of fiscal year 2019 relating to Eni, PMO, EGP, and the U.S. Navy SBIR grant. The MES and ONR contracts were completed in the first half of fiscal year 2018.

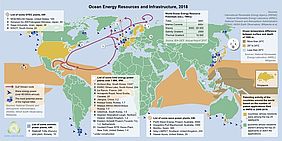

The company markets its products in multiple global regions, including parts of North America, Europe, South America and Asia. Revenues from customers who are based outside of the U.S. accounted for 92% of total revenues in fiscal 2019 and 86% of total revenues in fiscal year 2018.

The company has incurred net losses since it began operations in 1994, including net losses of $12.2 million and $10.2 million in fiscal 2019 and 2018, respectively. As of April 30, 2019, the company had an accumulated deficit of $209.8 million, compared to $197.5 million in 2018. To date, the activities of the company have consisted primarily of activities related to the development and testing of its technologies and PowerBuoy®. Thus, the losses to date have resulted primarily from costs incurred in research and development programs and from selling, general and administrative costs.

Cost of revenues for the fiscal years ending April 30, 2019, 2018 and 2017 were approximately $1.3 million, $0.8 million and $0.9 million, respectively. The increase of approximately $0.5 million, or 71%, over 2018 is mostly due to higher spending and material costs on the new customer contracts in fiscal year 2019 as compared to the same period in the fiscal year 2018.

Engineering and product development costs during the fiscal year ending April 30, 2019 were $5.0 million as compared to $4.3 million for fiscal year 2018. The increase of $0.7 million, or 15%, is due to higher spending on new products being developed, PB3 PowerBuoy® builds for future customer contracts, and higher personnel costs as compared to the same period in fiscal year 2018.

Selling, general and administrative costs during the fiscal year month ending April 30, 2019 were $7.6 million as compared to $7.0 for fiscal year 2018. The increase of $0.6 million, or 9%, is primarily attributable to higher investor relations costs of $0.4 million, higher professional fees of $0.2 million and higher sales and marketing of $0.1 million.

Since the company's inception, the cash flows from customer revenues have not been sufficient to fund operations and provide the capital resources for the business. For the two years ending April 30, 2019, the aggregate revenues were $1.1 million, while the aggregate net losses were $22.4 million. The aggregate net cash used in operating activities was $22.8 million.

Since 2002, government agencies have accounted for a significant portion of the company´s revenues. The revenues achieved were largely for the support of development efforts relating to the company´s technology. Today the company´s goal is to generate the revenues from the sale or lease of its products. The company still expects to have a net loss of cash from operating activities unless it achieves positive cash flow from the commercialization of its products and services.

However, there is significant uncertainty about the ability of the company to successfully commercialize PowerBuoys® in its targeted markets. The company cannot assure that it will be able to increase revenues and cash flow to a level which would support operations, provide sufficient funds to pay obligations for the foreseeable future, become profitable, raise additional outside capital or to continue as a going concern. If it happens, the company would be forced to cease operations, in which investors would lose their entire investment in the company.