NextEra Energy Inc. (NEE) is one of the largest electric power companies in North America and a leader in the renewable energy. The company operates approximately 45,500 megawatts of net generating capacity and employs approximately 14,300 people in 33 states and Canada. During 2018, NEE conducted its operations principally through its two wholly owned subsidiaries, FPL and NEER. With one of its principal subsidiaries, NextEra Energy Resources (NEER), the Company is the world's largest generator of renewable energy from wind and sun. Through its subsidiaries, NextEra Energy generates clean, emission-free electricity from commercial nuclear power units.

NEE has two principal businesses, FPL and NEER. FPL is the largest electric utility in the state of Florida and one of the largest electric utilities in the U.S. FPL invests in generation, transmission and distribution facilities to deliver low bills, high reliability, outstanding customer service and clean energy solutions for more than ten million people through more than five million customer accounts. On December 31st, 2018, FPL had approximately 24,500 MW of net generating capacity, approximately 75,200 circuit miles of transmission and distribution lines and 645 substations. In July 2018, FPL acquired a retail gas business.

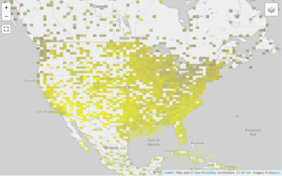

NEER, with approximately 21,000 MW of total net generating capacity as of December 31st, 2018, is one of the largest wholesale generators of electric power in the U.S., with approximately 20,400 MW of net generating capacity across 36 states, and has 500 MW of net generating capacity in 4 Canadian provinces and 99.8 MW of net generating capacity in Spain. NEER is the world's largest generator of renewable energy from wind and sun. NEER develops and constructs battery storage projects, which when combined with its renewable projects, serve to enhance its ability to meet customer needs for an almost firm generation source. NEER also owned and operated approximately 185 substations and 1,135 circuit miles of transmission lines owned and operated the four nuclear units on December 31st, 2018.

During 2018, 2017 and 2016, approximately 85% of NEER's revenue was derived from wholesale electricity markets.

According to the Annual Report 2018, NEE's operating revenues derived from the sale of electricity and amounted to $16.7 billion in 2018 compared to $17.2 billion in 2017 and to $16.2 billion in 2016, representing a decrease of 3% over the previous year. Operating revenues for 2018 decreased by $0.5 million, primarily due to lower revenues of approximately $718 million related to the deconsolidation of NEP.

Net income attributable to NEE for 2018 was $6.64 billion, compared to $5.38 billion in 2017 and $2.91 billion in 2016. In 2018 and 2017 net income attributable to NEE improved due to higher results at FPL and NEER, and in 2017 higher results at Corporate and Other. Net income attributable to NEE for 2018 was higher than 2017 by $1,258 million, or $2.49 per share, due to higher results at FPL and NEER, partly offset by lower results at Corporate and Other.

For the five years ended December 31st, 2018, NEE delivered a total shareholder return of approximately 134.4%.

FPL's increase in net income in 2018 was primarily driven by continued investments in plant in service and other property and the absence of the 2017 net impact of storm restoration costs due to Hurricane Irma. Fuel, purchased power and interchange expense decreased $291 million and increased $294 million during 2018 and 2017, respectively. The decrease for 2018 primarily relates to higher fuel expense and approximately $129 million in lower capacity fees. FPL deferred approximately $176 million and $11 million of retail fuel costs in 2018 and 2016, respectively, compared with the recognition of approximately $49 million of deferred retail fuel costs in 2017. The increase for 2017 primarily relates to approximately $314 million of higher fuel and energy prices.

NEER's results increased in 2018 primarily reflecting NEP investment gains upon deconsolidation and the absence of the 2017 Duane Arnold impairment charge and lower income tax expense.

In 2017, the enactment of tax reform required NEE and its subsidiaries to revalue their deferred income tax assets and liabilities to the new 21% federal corporate income tax rate.

In 2018, NEER added approximately 1,406 MW of new wind generating capacity, 899 MW of wind repowering generating capacity and 326 MW of solar generating capacity in the U.S.

NEER’s net income for 2018, 2017 and 2016 was $4,664 million, $2,964 million and $1,118 million, respectively, resulting in an increase in 2018 of $1,700 million and an increase in 2017 of $1,846 million.

Operating expenses for 2018 decreased $728 million, primarily due to the absence of $412 million of operation expenses related to NEP, which is no longer consolidated.

On December 31st, 2018, NEE's total net available liquidity was approximately $7.0 billion.

NEE´s goodwill amounted to $891 million at the end of 2018 and increased by 16%, compared to $764 million at the end of 2017. In 2017 the goodwill decreased slightly by 2%, compared to $780 million at the end of 2016.