The European Statistical Office Eurostat presented data on primary energy production and imports in the EU in 2020, comparing them with the developments observed in the period between 2010 and 2020. In general, the published data demonstrate the EU's growing dependence on energy imports from non-member countries. Thus, in 2020, almost 60% of the EU's gross available energy came from imported sources.

From 2010 to 2020, there was a decline in primary energy production in the EU, totaling 24 027 petajoules (PJ) in 2020, 7.1% lower than a year earlier and 17.7% lower than a decade earlier. This fall can be attributed to a number of reasons, including efforts to decarbonize and improve energy efficiency, depleting fossil fuel reserves, and, of course, in 2020, the impact of the pandemic.

Looking at EU member states individually, France had the highest level of primary energy production in 2020 with a share of 21.4% of the EU total, followed by Germany (17.1%), Poland (10.1%), Italy (6.6%), Spain (6.2%) and Sweden (6.1%). There are significant differences in the figures if we look at the share of sources of total energy production in the leading countries. Thus, high rates in France are due to nuclear energy (75%), in Germany and Italy due to renewable sources (48% and 72%, respectively), and in Poland due to solid fossil fuels (69%).

More than a third (40.8%) of total EU production comes from renewables, followed by nuclear energy (30.5%), with solid fossil fuels in third place (14.6%, mostly coal and lignite). The remaining 14% is distributed among natural gas (7.2%), crude oil (3.3%) and other sources (3.7%), such as natural gas liquids, peat, oil shale and oil sands, waste etc.

The dynamics of the growth of EU primary production from different types of energy deserves special attention. The figure below shows that renewables take the lead here, with a relatively steady growth rate of about 39% over the period 2010-2020. In contrast, production from other sources decreased, with the largest drops recorded for natural gas (-62%), solid fossil fuels (-43%), crude oil (-35%) and nuclear energy (-20%).

As mentioned above, the EU's energy industry is import-dependent, and all of its member states are net energy importers. Russia was the main source of energy imports to the EU throughout the period 2010-2020 for natural gas, crude oil and for coal, whereby imports of Russian natural gas increased from 26.3% to 34.5% and hard coal supplies have more than doubled. Norway remains the second largest supplier of natural gas and crude oil imported by the EU: even though its share of gas fell slightly over the period under review from 17.2% in 2010 to 16.2% in 2020. Norwegean crude oil, on the other hand, slightly increased from 7.7% to 8.7%. Algeria is the third largest supplier of natural gas to the EU (6.9%), followed by Qatar (6.8%). With 8.7%, Kazakhstan is the second largest supplier of crude oil. Beginning in 2015, the U.S. began tapping the EU market and became the fourth largest supplier of crude oil, increasing its share from almost zero in 2014 to 8.1% in 2020.

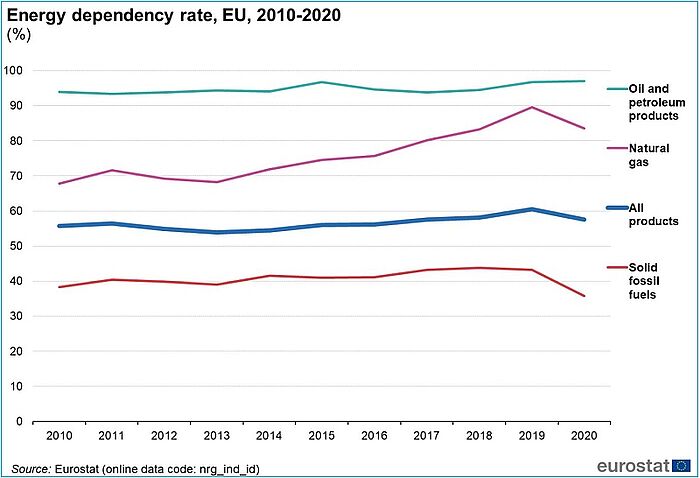

The illustration below shows that the EU's dependence on energy imports has not changed significantly over the past decade – from 55.8 % of gross available energy in 2010 to 57.5 % in 2020. Estonia, Romania, Sweden and Bulgaria recorded the lowest energy dependence rates in 2020. By contrast, Malta, Cyprus and Luxembourg were almost completely dependent on imports, with dependency ratios ranging from 92.5% to 97.6%. The highest imports in 2020 were for crude oil (97.0%) and natural gas (83.6%), and the lowest for solid fossil fuels (35.8%).

As can be seen from Eurostat data, EU's net energy imports exceeding its primary production and the countries of the Union are highly dependent on supplies from other regions of the world. In addition, a large share of imports is concentrated in a relatively small number of partners and this affects the energy security of the region, not least due to recent political developments related to Russia.