As always in January, Baker Hughes has published the 2021 final drill rig count data for major regions and countries of the world on its website.

A change in the number of rigs may be indicative of the level of business activity in the oil and gas sector and form the basis for forecasting future oil and gas production.

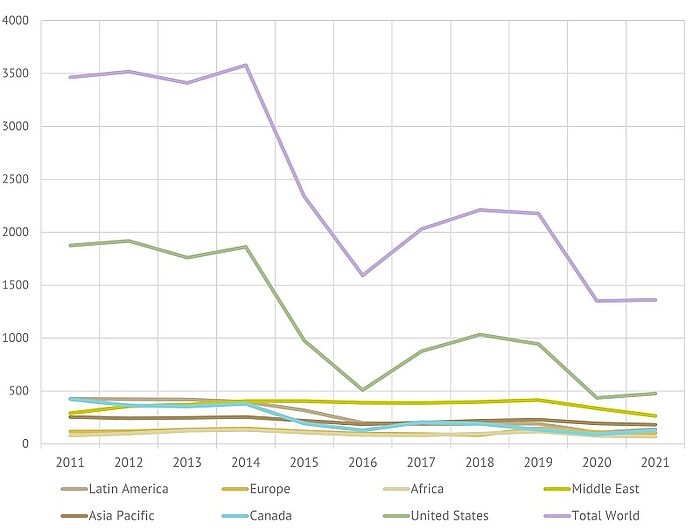

Last year, there was a huge drop in the number of active rigs compared to 2019 – by almost 38%, or 825 units. Similar figures can be found in the OPEC data – the number of rigs in 2020 is down by 788 units.

When analysing the data from last year, we noted that this may have been due to the synergistic effect of several factors, including a slowdown in global economic growth, a growing imbalance between fossil fuel demand and consumption by the end of 2019, and of course the effects of the Covid-19 pandemic.

The data presented for 2021 show notable changes in some regions compared to the previous year, but the average annual number of rigs globally is virtually unchanged at 1,361 in 2021 versus 1,352 in 2020. An increase in the number of rigs was noted only in Canada – by 45 %, the USA – by 9% and Latin America – by 28% (Argentina – an increase of 76%). In contrast, the largest decrease was observed in the most important region of hydrocarbon production – the Middle East – and amounted to more than 21%.

Rig Count 2011-2020

Source: Baker Hughes

In general, the profile of changes in the global number of rigs according to the Baker Hughes methodology is determined primarily by data from the U.S., where the largest number of rigs is concentrated, and the changes are the most dynamic. For example, in January 2021, the U.S. accounted for 31% of the total number of rigs, while in December of the same year it had already reached 37%.

Looking at the monthly changes in the number of rigs in 2021, it should be noted that their number increased very significantly from January to December, from 1,183 to 1,563, or by 32%. This was especially characteristic of the USA again.

No less optimistic data is given by OPEC. As of November 2021, the number of rigs in the world stood at 1,650, up from less than 1,350 in the first quarter. The vast majority were oil wells – 1326.

Floating production, storage, and offloading (FPSO), Brazil

Thus, according to the number of operating drilling rigs, by the end of this year there is a noticeable recovery in hydrocarbon production. This development is also confirmed by the increase in oil demand. If at the end of 2020, according to OPEC calculations, it was 91 mb/d, by the end of 2021 it increased to 96.6 mb/d and in 2022 the average annual demand for oil is expected by OPEC to reach the level of 100.8 mb/d. In addition, earlier by the end of 2020 OPEC recorded a slight increase in global oil reserves to almost 1,550 mb/d.

However, it would be premature to speak with certainty about a full recovery of the oil and gas industry. First, the constant emergence of new strains of the coronavirus does not allow us to unambiguously predict a reversal towards sustainable economic growth. Second, according to the same OPEC data, upstream investment in its member countries has declined over the past five years from $40 billion/year in 2017 to less than $15bn in 2021. In addition, one should not forget the decisions made at the last COP-26 Summit in Glasgow, in particular the Statement on International Public Support for the Clean Energy Transition. About 40 countries and organizations signed this document, including the USA, Canada, the UK, Sweden, the Netherlands, and the parties intend to "... end new direct public support for the international unabated fossil fuel energy sector by the end of 2022...".