The availability of a number of metals and minerals is becoming increasingly important for the development of renewable energy as they are used as components in various devices, as bases or alloying additives, as catalysts, etc. Among them, lithium, cobalt, palladium, rare earth metals, and gallium should be mentioned first. The reasons why these materials are of such great concern are limited raw material resources, complications in supply chains, and expanding the areas of use of these metals. The U.S. Geological Survey (USGS) periodically publishes lists of 50 mineral commodities critical to the U.S. economy and national security, which are formed according to an extensive methodology, including expert assessments.

Lithium

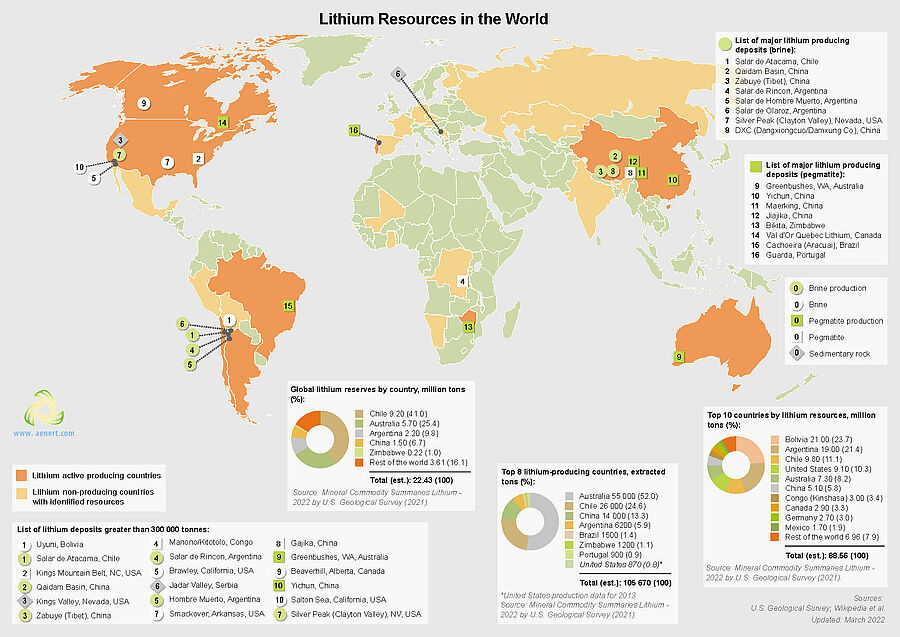

Lithium is the main component of lithium-ion batteries, which in turn are the most important element of electric vehicles. Over the past year, according to the USGS, global lithium reserves increased by one million tons to 22 million tons, mainly due to Australia. The increase in reserves has thus slowed considerably compared to 2020. In addition, BP estimates total lithium reserves at 20.255 million tons, noticeably less than the USGS. At the same time, global mine production has increased by more than 17% to 100,000 tons per year. Leaders in lithium production are Australia (55%), Chile (26%) and China (14%).

Over the last five years, the total growth of lithium reserves has been more than five million tons, which is much more than global production. So, there is no overall shortage of the metal yet. However, since the main lithium reserves are concentrated in South America and Australia, and battery production in Southeast Asia, the United States and Europe, there is a significant dependence of these regions on the timeliness of lithium production and supply, which will only increase in the future.

Lithium. Global production and reserves.

Source: USGS

Cobalt

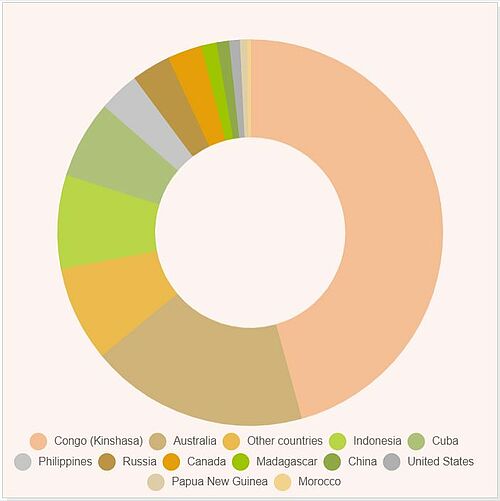

Cobalt is widely used for alloying steel and as a component of special magnetic and heat-resistant alloys that are important in power engineering. In addition, cobalt is a component contained in the cathodes of various types of batteries, including lithium-ion and nickel-cadmium batteries. The USGS estimated global cobalt reserves in 2021 at 7.6 million tons (up 0.5 million tons) whereas BP at 6.8 million tons. More than 50% of the reserves are concentrated in the Republic of Congo and another 20% in Australia. Global cobalt production has more than tripled in the last twenty years, reaching 170,000 tons in 2021 (an increase over the previous year of 28,000 tons). The current cobalt price is about $60,000/t. However, in 2018 it exceeded $90,000/t. Cobalt is a critical mineral not only for the United States, but also for many other countries, because its consumption is growing significantly around the world, while the growth of reserves is inconclusive, and they are concentrated in a handful of countries.

Cobalt. World Mine Reserves. Distribution by country

Source: USGS

Palladium

Palladium, which belongs to the platinum group of metals, is used in various sectors of modern energy. First of all, this concerns catalysts for the oil industry, as well as exhaust systems for cars. In addition, palladium is indispensable for obtaining high-purity hydrogen, where it is used in separating membranes. Since a large-scale increase in hydrogen production is planned, it is obvious that an adequate increase in palladium production will also be required.

According to the USGS, more than 90% of platinum-group metals reserves are concentrated in South Africa and another 6.5% in Russia. In 2021, the world produced 200 thousand tons of palladium. Of these, 74,000 tonnes were produced in Russia, 80,000 in South Africa, 17,000 in Canada and 14,000 in the USA. 10 years ago, in 2011, the USGS estimated the reserves of platinum-group metals at 66 million tons, and in 2021 at 70 million tons. During this time, a significant increase in reserves occurred only in Russia. However, total palladium production has used up more than half of those reserves during that time. The price of this metal has risen from 500 to 2000-2500/t. Thus, as in the case of cobalt, the inconclusive growth in reserves, the high degree of concentration of reserves in only a few countries and significant price fluctuations do not allow us to confidently assert a calm future for the industrial sectors that use palladium.