TESLA is a fully electric vehicles and energy generation company, which offers services related to sustainable energy products. Tesla operates in two segments: automotive and energy generation and storage.

The automotive segment includes the design, development, manufacturing, sales and leasing of electric vehicles.

The energy generation and storage segment include the design, manufacture, installation, sales and leasing of solar energy generation and energy storage products and related services and sales of solar energy systems incentives.

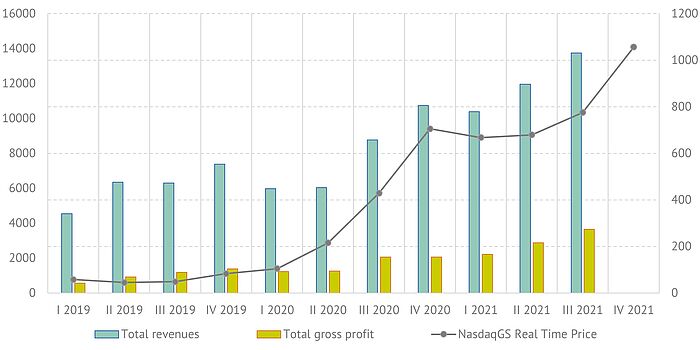

During the three and nine months ended September 30, 2021, Tesla recognized total revenues of $13.76 billion and $36.10 billion, respectively, representing increases of $4.99 (+57%) billion and $15.31 (+74%) billion, respectively, over the same periods ended September 30, 2020 according to the 3rd Quarter Report and results 2021.

Over time of 3 years total revenue grew up and increased threefold. The revenue of the energy segment remained stable and flat over time of 3 years with the revenue decrease in the second half of 2020 due to the pandemic of COVID-19. Gross profit grow up substantially and increased 6.5 times from beginning of 2019 until 3Q 2021.

Tesla. Total Revenue and Gross Profit, million $. Stock Price, $. 2019-2021

Source: U.S. Securities and Exchange Commission, Yahoo finance

During the three and nine months ended September 30, 2021, net income of the Company attributable to common stockholders was $1.62 billion and $3.20 billion, respectively, representing increases of $1.29 billion (+95%) and $2.75 billion (+611%), respectively, over the same periods ended September 30, 2020, so that the Company improved its profitability through production and operational efficiencies.

Tesla ended the third quarter of 2021 with $16.07 billion in cash and cash equivalents, representing a decrease of $3.32 billion from the end of 2020. Cash flows provided by operating activities during the nine month period ended September 30, 2021 was $6.91 billion, representing an increase of $3.99 billion compared to cash flows provided by operating activities during the same period ended September 30, 2020 of $2.92 billion, and capital expenditures amounted to $4.67 billion during the nine month period ended September 30, 2021, compared to $2.01 billion during the same period ended September 30, 2020. It allowed the Company to generally fund itself, but it will continue investing in a number of capital-intensive projects in the future.

In 2020, TESLA produced 509,737 vehicles and delivered 499,647 vehicles and deployed 3.02 GWh of energy storage products and 205 megawatts of solar energy systems.

According to Annual Report 2020, Tesla recognized total revenues of $31.54 billion, representing an increase of $6.96 billion or 28% compared to $24.58 billion in 2019.

In 2020 net income attributable to common stockholders was $721 million, representing an increase of $1.58 billion (+184%) compared to the prior year. In 2020 operating margin was 6.3%, representing a favorable change of 6.6% compared to the prior year.

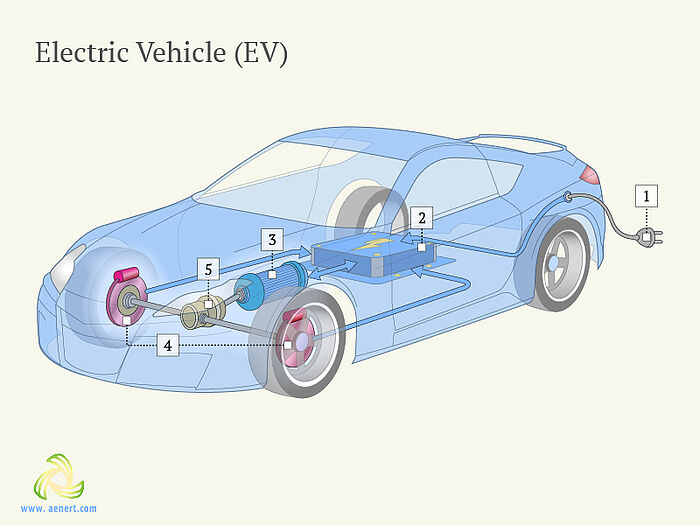

1. Power cord 2. Lithium-Ion battery system 3. Electric motor 4. Regenerative braking 5. Transmission

Source: www.aenert.com - CC BY-SA 4.0

The Company ended 2020 with $19.38 billion in cash and cash equivalents, representing an increase of $13.12 billion from the end of 2019. Cash flows from operating activities during 2020 was $5.94 billion, compared to $2.41 billion during 2019, and capital expenditures amounted to $3.16 billion during 2020, compared to $1.33 billion during 2019.

Tesla expects its capital expenditures to be $4.50 to $6.00 billion in 2021 and each of the next two fiscal years.

The COVID-19 pandemic impacted business and financial results in 2020.The temporary suspension of production at factories during the first half of 2020 caused production limitations. The Company took temporary labor cost reduction measures such as employee unpaid leave and compensation reductions. Additionally, the Company received benefits which helped to reduce the impact of the COVID-19 pandemic on financial results.

Segmentally, automotive sales revenue increased by $6.23 billion, or by 31% from $19.95 billion in 2019 to $26.18 billion in 2020, primarily due to an increase of 129,268 Model 3 and Model Y.

Automotive leasing revenue increased by $183 million, or by 21%, from $869 million in 2019 to $1.052 billion in 2020, primarily due to an increase in cumulative vehicles under direct operating lease program.

Services and other revenue increased by $80 million, or by 4%, in the year ended December 31, 2020, as compared to the year ended December 31, 2019, primarily due to an increase in non-warranty maintenance services revenue.

Energy generation and storage revenue , which includes sales and leasing of solar energy generation and energy storage products, services related to such products and sales of solar energy systems incentive, increased by $463 million, or by 30%, from $1.531 billion from 2019 to $1.994 billion in 2020, primarily due to increases in deployments of Megapack.

Cost of automotive sales revenue increased by $3.76 billion, or 24%, from $15.93 billion in 2019 to $19.69 billion in 2020, primarily due to an increase of 129,268 Model 3 and Model Y cash deliveries.

Cost of automotive leasing revenue increased $104 million, or 23%, in the year ended December 31, 2020, as compared to the year ended December 31, 2019, primarily due to an increase in cumulative vehicles.

Cost of services and other revenue decreased $99 million, or 4%, in the year 2020 compared to the year 2019, primarily due to a decrease in used vehicle cost of revenue.

Gross margin for total automotive increased from 21% to 26% in the year ended December 31, 2020, as compared to the year ended December 31, 2019, primarily due to an improvement of Model 3 gross margin primarily from lower material, manufacturing, freight and duty costs.

Gross margin for total automotive & services and other segment increased from 17% to 22% in the year ended December 31, 2020, as compared to the year ended December 31, 2019.

Cost of energy generation and storage revenue includes direct and indirect material and labor costs, warehouse rent, freight, warranty expense, other overhead costs and amortization of certain acquired intangible assets.

Cost of energy generation and storage revenue increased by $635 million, or 47%, in the year ended December 31, 2020, as compared to the year ended December 31, 2019, primarily due to increases in deployments of Megapack.

Gross margin for energy generation and storage decreased from 12% to 1% in the year 2020 compared to the year 2019, primarily due to a higher proportion of Solar Roof in overall energy business which operated at lower gross margins as a result of temporary manufacturing underutilization.

Research and development (R&D) expenses, which primarily consist of personnel costs for teams in engineering and research, manufacturing engineering and manufacturing test organizations, prototyping expense, contract and professional services and amortized equipment expense, increased by $148 million, or 11%, from $1.34 billion in 2019 to $1.49 billion in 2020.

R&D expenses as a percentage of revenue decreased from 5.5% to 4.7% in the year ended December 31, 2020, as compared to the year ended December 31, 2019. The decrease is primarily an increase in total revenues from expanding sales.

As of December 31, 2020, the Company had $19.38 billion of cash and cash equivalents and was able to fund itself in 2020. During 2021 the Company continued to rump-up production, to build new manufacturing capacity and expand operations to enable increased deliveries and deployments of products and further revenue growth.