Aenert news. Energy resources and infrastructure

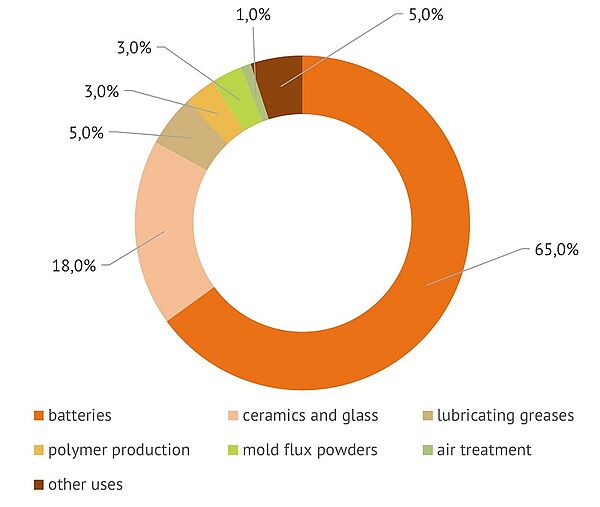

The rapid growth in sales of various types of electric vehicles in 2021 and 2022 has caused a high demand for lithium from lithium-ion battery manufacturers. According to the USGS, batteries accounted for 65% of the global end-use markets for lithium in 2020. Now, according to some sources, this share may be as high as 80%.

This seems quite obvious when taking into account that total sales of EVs and PHEVs in the world increased by more than 40% in 2020, by almost 110% in 2021, and in 2022 according to preliminary data they increased by another 55-57% and reached more than 10.5 million units.

Last year, the main contribution to this process was made by China, where about 60% of the total volume of electric vehicles was sold.

Lithium global end-use markets 2020

Source: USGS

Such results naturally affected the lithium market, primarily in China, where about three-quarters of the world's lithium production capacity is found. At the same time, China, remaining a major producer of lithium concentrates, sharply increased imports of lithium carbonate, which led to a staggering surge in the cost of all types of lithium products. In November 2022, the price of lithium carbonate came close to 600,000 yuan per tonne (CNY/T), up from less than 50,000 CNY/T in mid-2020. And, although by the end of February 2023, prices had fallen to less than 400,000 CNY/T, market tensions remain.

To the delight of shareholders of lithium mining and processing companies, they will see extremely high dividends for 2022. Most producers, including Albemarle (USA), Livent Corp. (USA), Sociedad Química y Minera de Chile, and Ganfeng Lithium Group (China), have significantly increased their revenues in 2022 compared with last year.

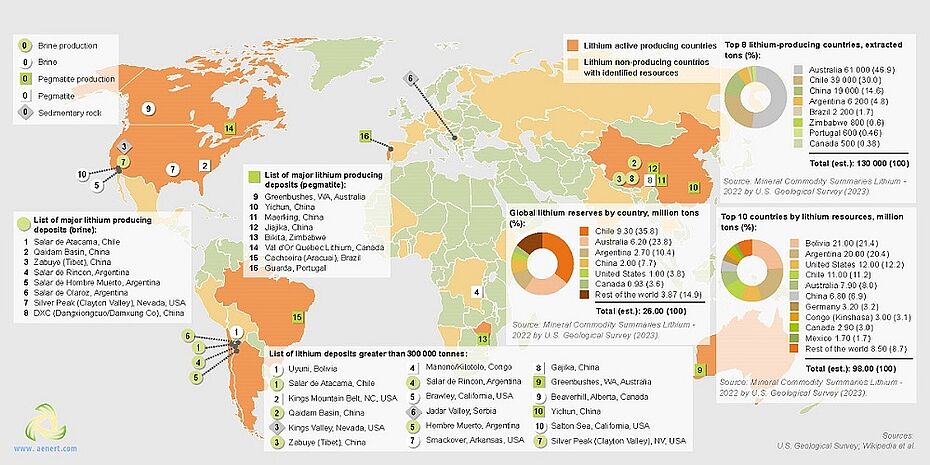

Certainly these market trends are of concern in terms of the resource availability of lithium-ion battery production. A recent U.S. Geological Survey report gives a clear picture of the nature of this issue.

First of all, it should be noted that global lithium reserves increased by 18% compared to the previous year and reached 26 mln t. The main volumes of reserves are still located in Chile - 9.3 mln t, which increased by 100,000 t over the year. Australia (6.2 mln t), Argentina (2.7 mln t) and China (2 mln t) also have large reserves.

Australia remained the world's leading producer of mined lithium last year, with over 60,000 tons (up 10%). However, companies in Chile were increasing lithium production even more intensively – 39,000 tons (+38%) and China – 19,000 tons (+36%). A total of 130,000 t of lithium was produced worldwide in 2022 (excluding the US), or 21.5% more than in 2021.

Lithium. Global mine production and reserves

Source: USGS

For countries with reserves of at least 1 million tons, the largest percentage increase in 2022 was made by China – more than 33%. In Argentina, this figure was 22.7%, in the USA – 25%, in Chile – almost 11%.

According to the U.S. Geological Survey, lithium resources worldwide have grown significantly over the past year, reaching 98 million tons, compared to 88.56 million tons in 2021 (up 10.6%). The largest lithium resources are concentrated in Bolivia and Argentina (21 and 20 million tons, respectively). Resources in the U.S. increased by more than 30% and reached 12 mln t. Key information on global lithium production is presented on the map below.

Map of global lithium production and reserves

The above data, despite the aggravated situation in the lithium markets, inspire reasonable optimism. Firstly, many lithium producers in 2022 significantly increased both the volume of proven reserves and lithium production, demonstrating the sustainability of technological processes and supply chains. Secondly, there is a gradual increase in lithium-ion battery production capacity around the world, which will further smooth out price fluctuations in the market, and thirdly, the global resource potential of lithium is significant, which, combined with growing demand for batteries, determines the commercial interest in the development of new deposits.

By the Editorial Board